To clients and friends of The London Company

Chasing Gold

Executive Summary

- Stock returns were mixed in Q2, with large-cap growth stocks continuing their momentum and everyone else lagging behind.

- The continued highly concentrated rally raises questions about future market leadership – will other companies catch up, or will the mega-caps face a pullback due to heightened growth expectations?

- Investor complacency towards risk has grown, partly due to the consistency of returns in the S&P 500 Index, obscuring individual stock volatility and emerging risks.

- As Momentum has driven the market, our portfolios have gained on an absolute basis this year but underperformed on a relative basis. We remain focused on higher Quality, lower Volatility factors emphasizing downside protection while capturing 85% to 90% of the market upside.

- In our view, this uncertain economic backdrop warrants an investment approach that prioritizes consistency and stability—not excessive wagers.

As the Summer Olympics approach in Paris, we look forward to the captivating stories of Olympians who have defied the odds, overcome adversity, and dedicated countless hours to achieving excellence. We believe these athletes have earned our attention. Recently, the rise of mobile sports betting has brought a different kind of attention to the Games. We hope this betting frenzy doesn’t overshadow the thrill of hard-fought athletic achievements. Similarly, in today’s momentum-driven market, the line between short-term bets and long-term investments has become increasingly blurred, making it more crucial than ever to distinguish between chasing short-term gains and investing for long-term wealth creation.

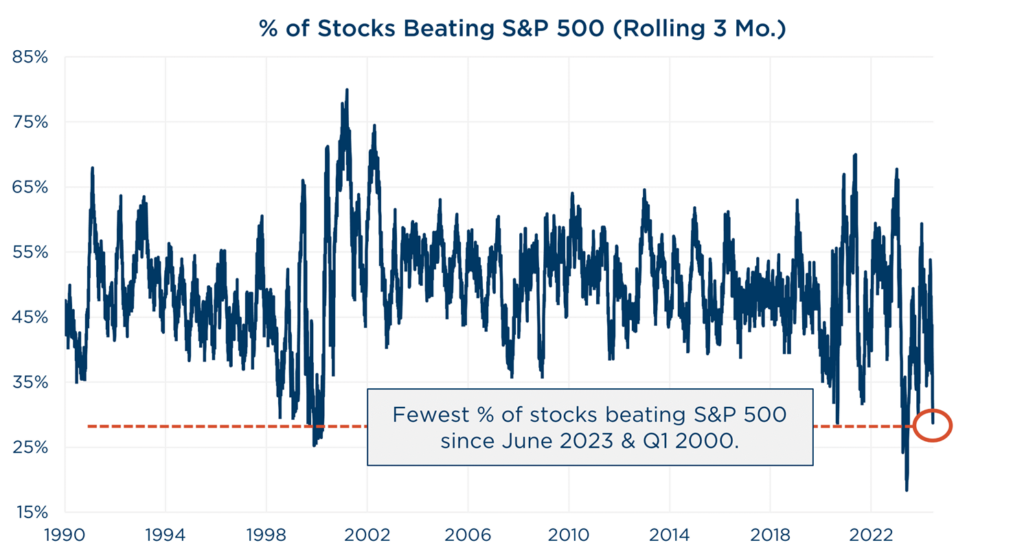

The S&P 500 reached new all-time highs during the quarter, but market breadth (a measure of how many stocks are participating in the rally) plummeted yet again. Despite a relatively strong earnings season, most equities beyond the Large Cap Growth space finished the quarter lower. The S&P 500 was up 4.3%, while the Russell 2000 declined -3.3%. Diminishing expectations of a summer rate cut, emerging signs of consumer weakness, and some softness in interest-rate-sensitive businesses were notable headwinds.

Artificial intelligence (AI) enthusiasm continued to boost growth stocks, but the biggest gains were driven by a narrow group of mega-caps again. Results for the Magnificent 7 have been more dispersed in 2024, but the group’s collective value surged by a whopping $2T during Q2 and now reflects a record 32% of the S&P 500. NVidia has been the biggest beneficiary of the AI arms race thus far. The stock is up 150% in 2024 and is responsible for 30% of the S&P 500’s YTD gain. The longer the winning streak of mega-caps continues, the more that speculation grows on what may end it. Will other companies catch up through the dispersion of AI productivity? Or will the mega-caps fall back to the pack through a selloff or an inability to keep up with aggressive growth expectations?

Source: Piper Sandler. Data from 1/2/90-6/17/24.

This speculation should not distract from market dynamics beneath the mega-cap rally, particularly the dynamic of investor complacency toward to risk. The S&P 500 Index has gone over 340 trading days without a -2% decline (3rd longest stretch going back 25 years). Meanwhile, equity volatility, credit spreads and short interest are sitting at post-pandemic lows. Investors’ focus on momentum stocks and mounting optimism may also be contributing to more cavalier bets in the market. We have seen a return of meme stocks, such as GameStop, while the share of penny stock trading volumes has reached all-time highs.

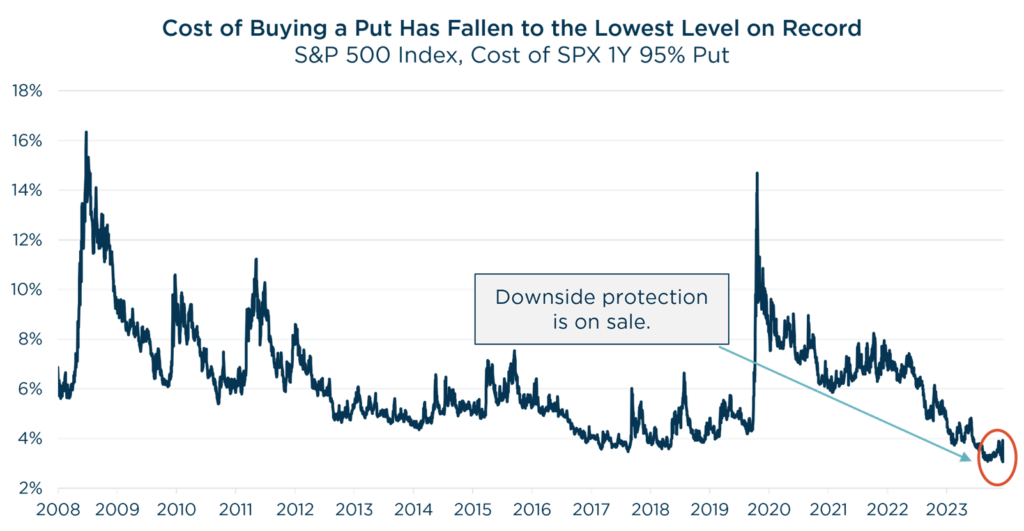

Despite a yield curve that has remained inverted for the longest stretch in history, downside protection has been devalued. The cost of buying a put – a defensive hedging strategy – has reached an all-time low. The calm waters suggested by broader index performance belie the volatility of individual stocks. The individual volatility of stocks against a backdrop of steady index performance can test the patience and conviction of long-term investors. That said, the rising tide of amnesia toward risk is concerning, and we believe vigilance and discipline are as important as ever.

Source: Piper Sandler & Bloomberg. Data from 5/31/08-5/10/24.

Strategy Recap

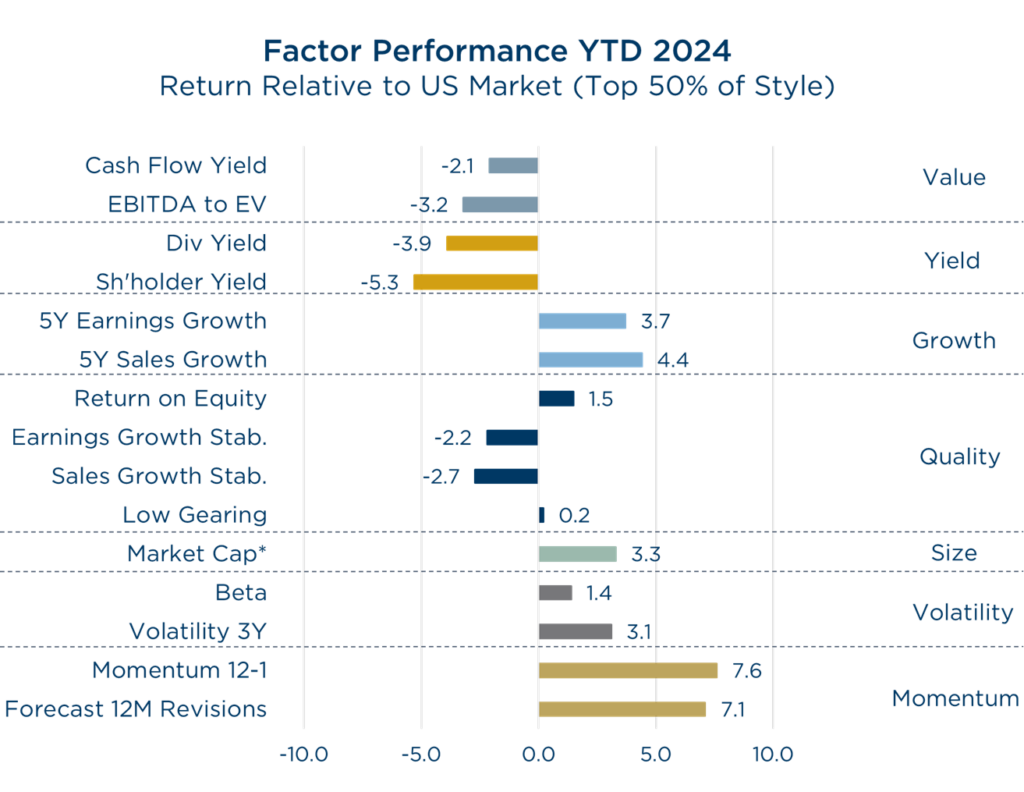

This devaluation of risk mitigation was felt across our portfolios, which finished the second quarter in negative territory and delivered mixed results. Our approach faced headwinds as Momentum, Growth, and Volatility factors continue to lead, and the factors we emphasize, such as Quality, lower Volatility and Yield, remain out of favor.

Down the market cap spectrum, major indices declined, and our Mid, SMID, & Small Cap portfolios came up short of our 75% downside capture expectations. These portfolios have no exposure to Utilities, the best performing sector in Q2, and weakness in some of the portfolios’ Consumer Staples, Healthcare, and Materials holdings presented headwinds to relative performance. All three have positive absolute returns for the year, with Small Cap & SMID exceeding our 85-90% upside capture expectations.

For the quarter and year-to-date, the opportunity cost from underexposure to the ten largest mega-caps continues to be the main headwind to relative performance for our Large Cap & Income Equity portfolios versus their large cap core benchmarks. That said, the Income Equity portfolio exceeded our 75% downside capture target versus the Russell 1000 Value index during Q2.

It is hard to know when market factor data will shift, but we note the strong performance in Quality factors (sustainably high and improving ROIC, balance sheet strength) over many decades. We have not experienced any portfolio drift and our key metrics look strong. Owning great businesses at reasonable prices and allowing them to compound is still a winning strategy. It is not always easy to be a quality, long-term oriented manager, but investors who remain focused on compounding returns are usually rewarded for their patience through the real economic value created over time.

Source: Style Analytics. Data as of 6/30/24. *Top 70% of U.S. Market.

Looking Ahead

The peak rate environment has created a favorable but precarious balance for equities. During prolonged rallies, market expectations tend to escalate alongside rising optimism, creating an environment where any deviation from stellar performance can trigger a correction. We remind investors that narrow markets are fragile markets. An unexpected Fed policy shift or underperformance in AI-driven earnings may swing the markets in a new direction.

Persistent yield curve inversion and mounting budget deficits pose underappreciated threats, potentially impacting bond and currency markets in unforeseen ways. Other significant factors we are watching include weaknesses at the retail and industrial levels.

Many areas in the market haven’t fully participated in the rally, and some attractive, high-quality opportunities are available at reasonable valuations. These include dividend payers, lower beta and lower volatility equities, and higher quality businesses in the Mid & Small Cap space. As earnings growth recovers in non-tech sectors, a more diverse set of companies could garner investor attention. To dampen portfolio concentration and valuation risk, investors may want to seek greater diversification away from the Magnificent 7 names. The time to prepare for that inevitable change in leadership is when things are going well, not during the actual correction.

In our view, this uncertain economic backdrop warrants an investment approach that prioritizes consistency and stability—not excessive wagers. We will continue to focus on the stories of companies with clear growth drivers and robust fundamentals. Like Olympians who have dedicated years to their goals, undeterred by short-term setbacks or outside noise, we believe investing in companies that demonstrate sustainable growth and resilience will win out in the long run.

As always, we appreciate and highly value the trust you have placed in us.

The rising tide of amnesia toward risk is concerning, and we believe vigilance and discipline are as important as ever.

View Our Strategies

For more information