To clients and friends of The London Company

Flipping the Script: Value & Yield Revival

Executive Summary

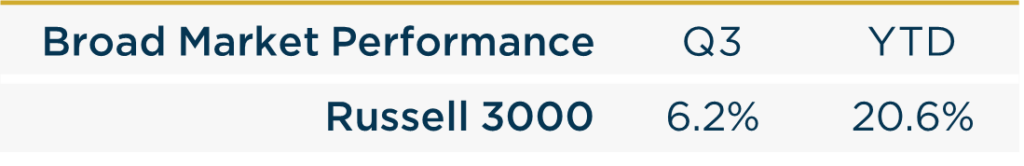

- The market ended Q3 on a high note, but the journey was turbulent with a ton of market-moving headlines.

- A series of leadership reversals occurred during the period with large-cap growth underperforming while small-cap value and rate-sensitive sectors gained, fostering increased market breadth.

- The reversals were felt across our portfolios, which delivered mixed results & a flip in relative fortunes. Large Cap & Income Equity benefited from the Value & Yield revival, and we believe they’re poised to build on this success in the future.

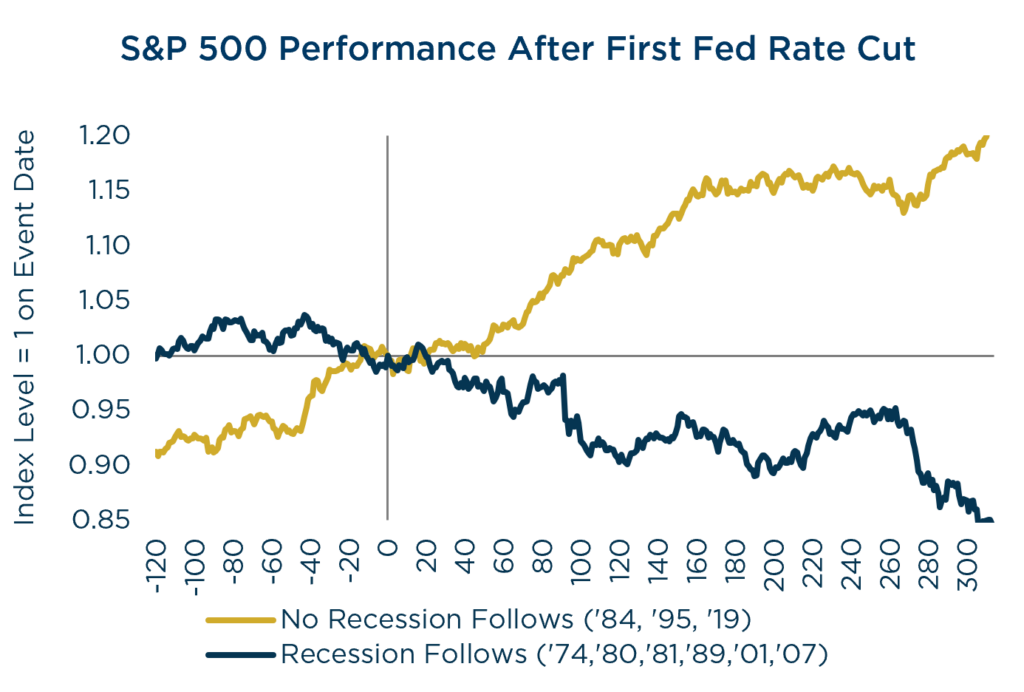

Buried in every piece of investment communication is the warning “Past performance is not indicative of future results,” and this market continues to validate that inscription, defying expectations and precedent—at least for now. The third quarter was packed with market-shifting headlines—cooling inflation, weakening employment, spiking volatility, shifts in market leadership, a Fed rate cut, geopolitical tensions, and plenty of presidential race drama. Yet, despite the turmoil, the stock market climbed the proverbial “wall of worry.” The Fed’s larger-than-expected half a percentage point cut fueled optimism about a soft landing and boosted investor sentiment.

The S&P 500 posted its fourth consecutive quarterly gain, up 22.1% YTD—the best first three quarters since the late 1990s. However, beneath the surface, there was significant movement. The “Magnificent 7,” key drivers of the index in the first half of 2024, became volatile and underperformed the broader S&P 500. This created space for broader market participation, with nearly 70% of stocks outperforming the index. The market saw a shift from large-cap growth to small-cap value and rate-sensitive sectors, with utilities and real estate emerging as top performers while tech and communication services struggled.

Although the Fed has a poor track record of ‘sticking’ soft landings, the market appears priced for one, despite troubling signs of economic weakness. We can’t say a recession appears imminent, but this economy doesn’t seem poised for rapid growth either. Corporate profits have been a bright spot, but excluding mega-cap growth stocks, the earnings picture is more fragile. Many companies have been riding the coattails of inflation to support pricing and insulate their earnings; meanwhile, volumes are down across many industries. It’s reminiscent of the famous Warren Buffett quote: “Only when the tide goes out do you discover who’s been swimming naked.” As inflation recedes, so will the ‘pricing power’ of lower-quality companies. Future earnings may rely more on cost-cutting, often through layoffs, which may explain Q3’s weaker employment data.

Source: Piper Sandler. 2019 episode excludes period of COVID selloff & recovery. 1980 periods goes through the first rate hike. Data from 3/14/1974 – 8/31/2024.

Strategy Recap

The reversals in Q3 were felt across our portfolios, which delivered mixed results and a flip in relative fortunes. After several quarters of underperformance, our Large Cap and Income Equity portfolios exceeded expectations, benefiting from increased volatility, broader market participation, and the rebound in Value and Yield market factors. Both portfolios protected well on the downside while staying ahead of their benchmarks in the sharp recovery. We believe these strategies are poised to build on their recent success in the quarters and years ahead.

On the flip side, our Mid Cap, SMID, and Small Cap portfolios underperformed, after several years of strong relative results. These portfolios didn’t fully benefit from the rotation away from mega-cap growth stocks. The areas of the market that rallied the most were lower-quality, highly leveraged companies, which stand to benefit the most from rate reprieve. Our focus on balance sheet strength, which typically benefits us, became a temporary headwind. Another challenge was having no Utilities exposure, one of best-performing sectors down-cap. While the short-term report card hasn’t been as favorable this year as the prior two, the longer term performance for each of these strategies is still strong.

Looking Ahead

tocks enter Q4 in good form, but challenges remain. The market appears priced for near perfection, with expectations of a soft landing and healthy earnings growth driving the S&P 500 to a lofty valuation of 21x forward earnings—leaving little room for error. Still, anything seems possible with this market. It has whistled past an expanding graveyard of warning signs that have flashed red. More recently, the Sahm Rule (i.e. sharp rate of change in the unemployment rate) recessionary indicator was triggered and the yield curve un-inverted. When these rules of thumb fail to work as promised, it’s natural to ask: Are these rules now obsolete? Or should they be rewritten? We would answer: Not just yet.

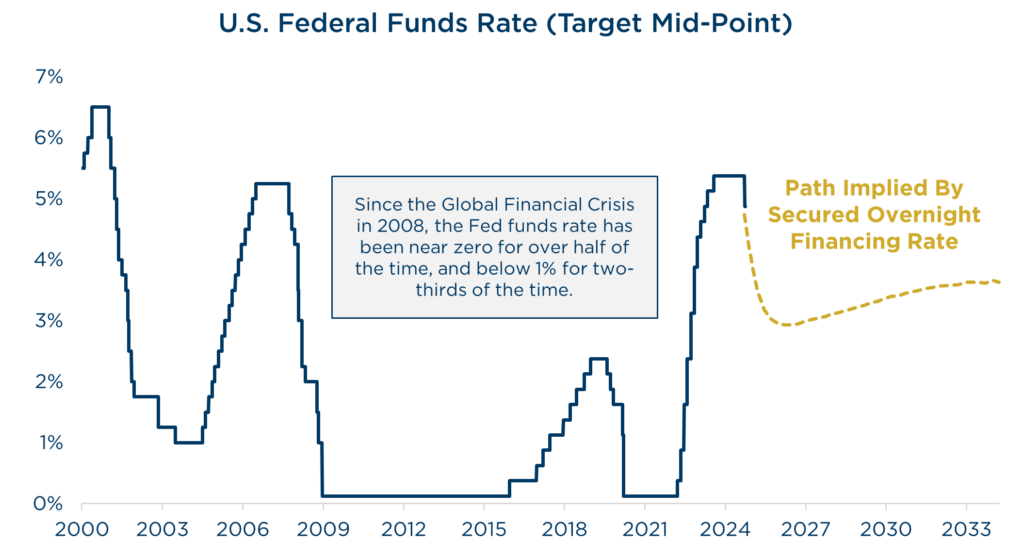

The Fed’s recent rate cut may sow the seeds for a cyclical recovery, but whether it arrives in time to avoid an economic downturn is uncertain. Further, interest rates are likely to settle higher than the ultra-low levels of the past 15 years. As a large corporate debt maturity wall approaches, balance sheet strength will become a differentiator and an advantage for investors focused on fundamentals.

Source: Piper Sandler. Data from 1/8/1971 – 10/2/2024.

Every cycle is unique, and we have too much reverence for the market to try and guess its next move. That said, we’re also keenly aware of the four most dangerous words in investing, “This time is different.” Looking ahead, we believe our focus on quality, diversification, and valuation will continue to reinforce our margin of safety, positioning our portfolios for success in this uncertain climate.

As always, we appreciate and highly value the trust you have placed in us.

We believe our focus on quality, diversification, and valuation will continue to reinforce our margin of safety, positioning our portfolios for success in this uncertain climate.

View Our Strategies

For more information