To clients and friends of The London Company

Restless Animal Spirits

Executive Summary

- The animal spirits driving 2024’s market performance reawakened in Q4, fueled by speculative momentum and low volatility, while clear late-cycle signals call for a disciplined approach.

- Our focus on quality, yield, and downside protection faced headwinds in a momentum-driven 2024.

- Looking ahead, we believe durable earnings and dividends may increasingly outweigh gains from multiple expansion and momentum in a late-cycle environment.

The animal spirits that drove markets to record highs in 2024 remained restless in the fourth quarter. Speculative flows and muted volatility show investors charging ahead despite growing late-cycle warnings. Amid these shorter days of winter, are these spirits preparing for hibernation, or have they missed the signals of an economic cycle showing signs of turning cold?

We believe the signals are clear. Stretched valuations, excessive investor optimism, and elevated levels of insider selling paint a picture of an economic landscape in transition, with strain beneath the surface. When the path narrows and the footing gets uneven, we focus on finding the next solid step, grounded in fundamentals.

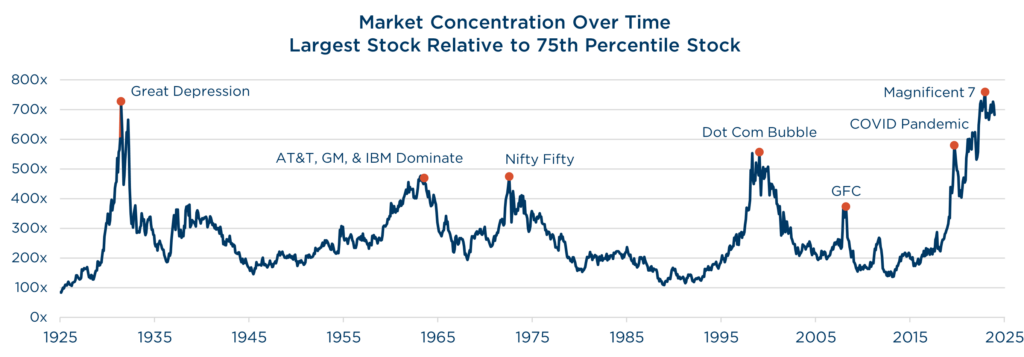

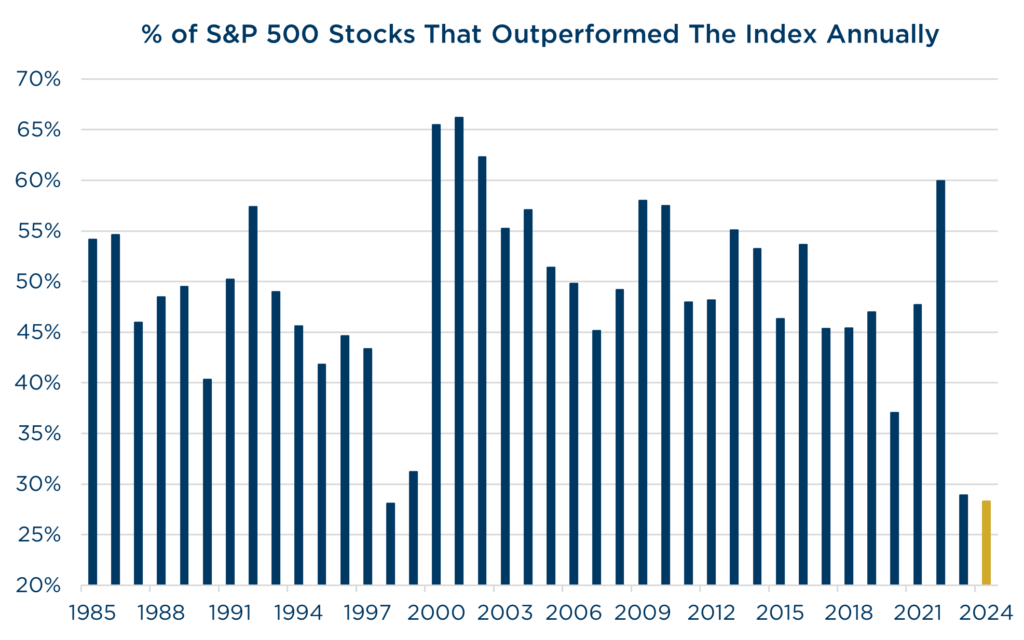

While equity markets delivered strong headline gains in 2024, these returns were largely driven by multiple expansion, leaving valuations elevated and the market increasingly reliant on a handful of mega-cap leaders. The S&P 500 ended the year trading at 22x forward earnings—well above historical averages. Concentration remains a concern, with a handful of companies driving the bulk of returns, while signals like weak housing starts and contracting PMIs point to a late cycle economy.

Source: Goldman Sachs Global Investment Research. Universe consists of U.S. stocks with price, shares and revenue data listed on the NYSE, AMEX, or NASDAQ. Series prior to 1985 estimated based on data from Kenneth French data library, sourced from CRSP, reflecting the market cap distribution of NYSE stocks.

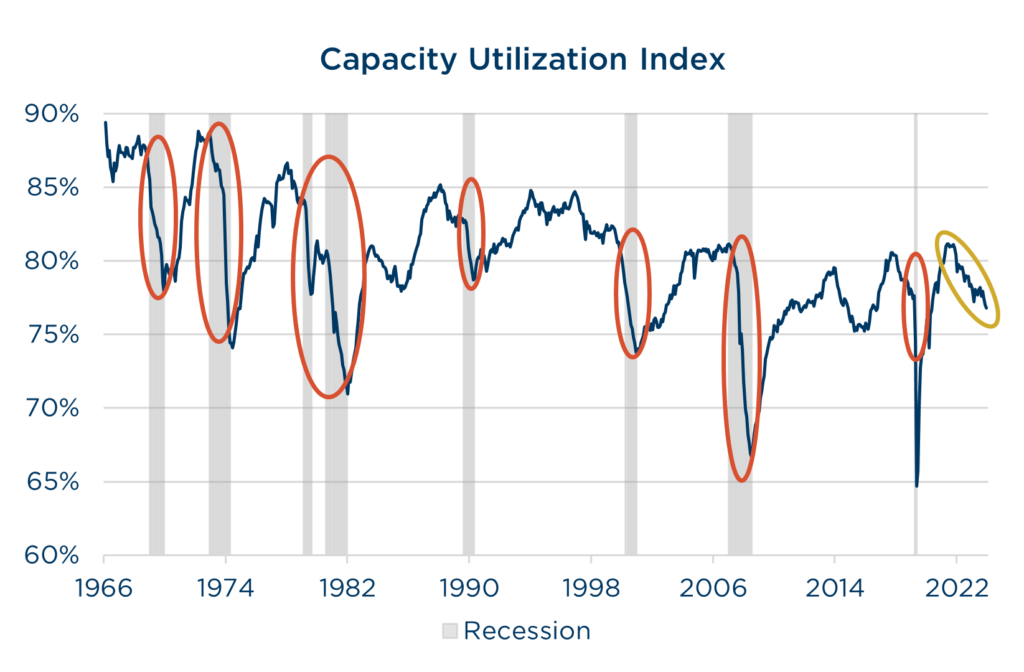

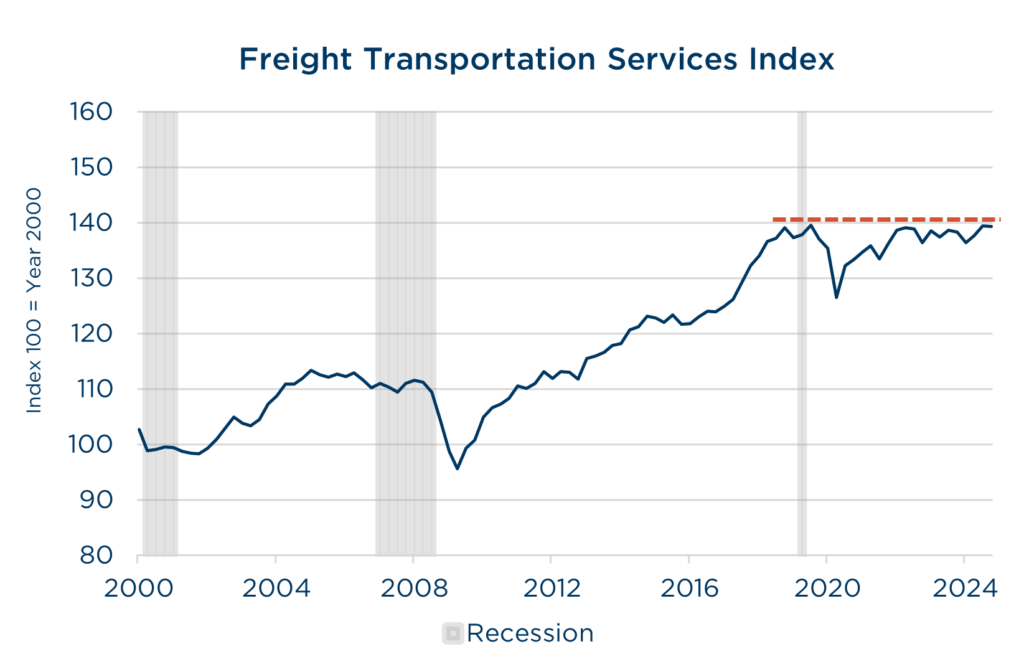

Complacency crept into the market, with rising valuations and muted volatility masking broader economic challenges. Across the real economy, demand still seems sluggish. Capacity utilization has fallen for two years straight, and freight volume—historically a good, broad indicator of the overall economy—has been in a recession since 2019. Revenue growth and corporate profits have leaned on inflationary pricing, but margins face growing headwinds as inflationary pricing fades, input costs rise, and demand softens.

Source: Federal Reserve Bank of St. Louis. Data from 1/1/1967 – 11/1/2024.

Source: Bureau of Transportation Statistics. Data from 1/1/2000 – 10/1/2024.

These signs highlight the economy’s late-cycle stage nature: high valuations, waning fundamentals, and investor complacency. It’s starting to look like a season that demands discipline and a recalibrated view of returns. When we stray too far from the fundamentals, even the wildest animal spirits can get frostbite.

Strategy Recap

Our portfolios produced mixed results amid cross currents in the fourth quarter. Our Small Cap and SMID portfolios outperformed their benchmarks and exceeded our 85-90% upside capture expectations. Our Large Cap, Income Equity, and Mid Cap portfolios underperformed their benchmarks and fell short of our expectations.

For the year, our Quality-at-a-Reasonable-Price approach broadly lagged in an environment dominated by Momentum and Growth factors across market caps. Our portfolios often lag during risk-on environments or when stocks compound at double-digit annual rates.

Our Small Cap portfolio was a bright spot, outperforming its bogey and exceeding upside participation expectations. Strong performance of select names and underweights to the weakest sectors of the index (e.g. Energy & Healthcare) drove solid relative results. Our Mid Cap and SMID portfolios produced solid absolute returns but fell short on a relative basis, largely owing to a couple of overlapping weak names.

With an emphasis on Quality, Value, and Yield factors, our Large Cap and Income Equity portfolios were out of favor versus the Core benchmarks for a second year in a row. That said, both portfolios had strong second halves of the year, and Income Equity finished in-line with our 85-90% upside participation expectations versus its primary Value benchmark.

The robust returns of 2024 were almost a carbon copy of 2023, producing the strongest 2-year period for the S&P 500 since the late 90s. The historically narrow market leadership was another source of déjà vu and analogous to the lead up to the Tech Bubble. The dominance of the Top 10 mega-caps created challenges for our portfolios in the first half of 2024 and Q4, but in Q3, broader market participation and increased volatility played to our strengths. If Q3 is an indicator of what the future looks like, then we believe our relative fortunes are due for a sustained rebound.

Source: Piper Sandler. Data from 12/31/1985 – 12/31/2024.

Finally, our International portfolio, which was incepted 15 months ago, outperformed its MSCI EAFE benchmark in Q4, for the full year 2024, and since inception. We hope to build on those strong results and demonstrate how the advantages of Quality transcend global equities.

Looking Ahead

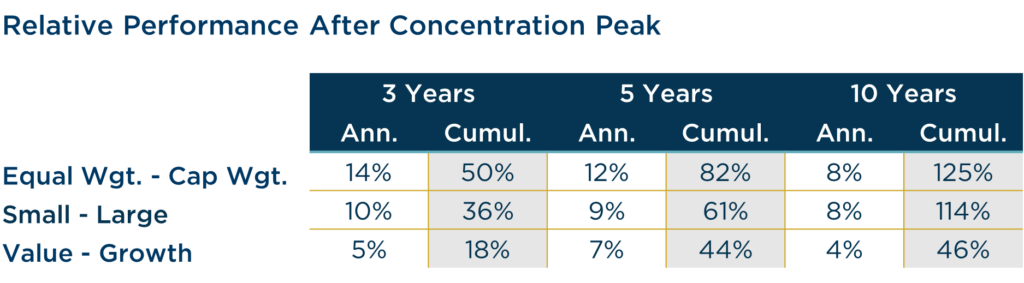

As we enter 2025, we believe the market faces an inflection point where sustaining momentum becomes increasingly difficult. Concentration and valuation risks are poised to hinder market-cap weighted index level returns. Even Vanguard—the king of passive investing—is forecasting 2-4% returns for large cap equity indices over the next decade, due to these risks. Historically, concentration peaks have marked a turning point, with diversification driving returns as leadership shifts. Smaller-cap stocks, value strategies, and equal-weighted indices have all outperformed their counterparts over subsequent 3, 5, and 10-year periods, as shown in the table. With elevated valuations, future returns will rely on earnings growth and dividends rather than multiple expansion.

Source: BofA Global Research. The study included diversification cycles following concentration peaks in 1932, 1957, 1973 and 2000. Proxies: Equal Weight = S&P 500 Equal Weighted Index; Cap Weighted = S&P 500; Small Cap = Russell 2000; Large Cap = Russell 1000; Value = Russell 1000 Value; Growth = Russell 1000 Growth.

Late-cycle economies have historically favored Quality—businesses with durable earnings and real return potential. Dividends, in particular, become essential when speculative momentum fades. At The London Company, we focus on stability and compounding, positioning portfolios to weather challenges and capture opportunities as fundamentals regain focus.

When the path narrows and the footing gets uneven, we focus on finding the next solid step, grounded in fundamentals.

While optimism remains high, the vulnerabilities of momentum-driven leadership highlight the need for discipline. Markets may reward risk-taking in the short term, but lasting wealth is built through patience, real income, and fundamentals. As winter deepens, we will keep watch to see if the animal spirits eventually come to rest.

As always, we appreciate and highly value the trust you have placed in us.

When the path narrows and the footing gets uneven, we focus on finding the next solid step, grounded in fundamentals.

View Our Strategies

For more information