To clients and friends of The London Company

Durable Signals

Executive Summary

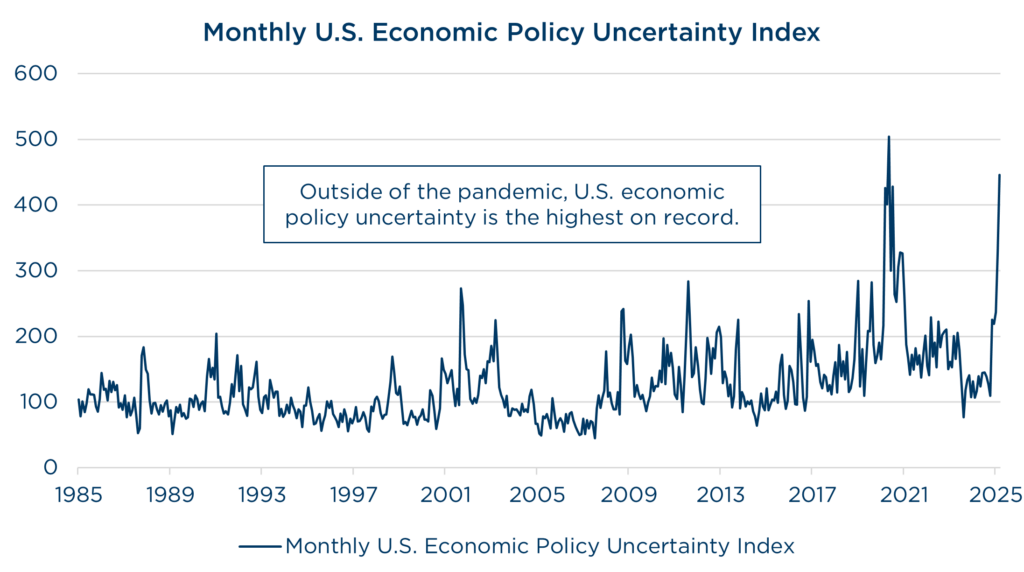

- Markets entered correction territory in Q1 amid policy uncertainty, including shifting trade policy and tariff risks.

- Momentum factors struggled while Low-Volatility, Yield, & Quality factors outperformed.

- The recent correction may have reset some expectations, but equity markets remain historically expensive & concentrated. Regime shifts after peak concentration can take years to fully play out.

- The challenge of separating signal from noise is not a new one. In today’s volatile markets, where earnings and policy shifts drive exaggerated reactions, we focus on enduring value—competitive advantages, strong earnings, healthy balance sheets, and tangible dividend income.

One of the most difficult challenges in investing is learning to distinguish signal from noise. As markets entered correction territory in Q1 and tariff-related policy uncertainty returned to the forefront, we are reminded that not all signals are created equal, and not all are worth following. Our job is to stay tuned to the right frequencies. Fortunately, for disciplined investors, those worth paying attention to don’t change much over time.

Investors faced no shortage of mixed signals in the first quarter. Wildfires, austerity measures, trade and economic policy seemed at times equally unpredictable. Renewed concerns about tariffs and a rapid wave of government downsizing introduced fresh uncertainty about the fiscal path ahead. Markets were left parsing a stream of headlines, some meaningful, others merely noise.

Source: policyuncertainty.com. Data from 1/31/1985-3/31/2025.

One notable signal flashed early in the quarter. DeepSeek, a relatively unknown Chinese AI company, unexpectedly upended market momentum, triggering a swift selloff in incumbent AI leaders. It was the first meaningful bear case to register, bringing attention to just how capital-intensive the AI buildout has become. Investors began asking overdue questions: Can AI infrastructure be delivered more cheaply? Will demand justify the massive spend? And can these companies sustain the earnings growth implied by their valuations?

AI momentum cracked for the first time, as did the illusion that its leadership would go unchallenged. The Magnificent Seven have carried the lion’s share of index performance in recent years, evoking echoes of past eras like the Nifty Fifty or the Tech Bubble. At year-end, the ten largest companies in the S&P 500 were worth roughly $20 trillion, while U.S. GDP stood around $30 trillion. At that pace, and with even modest assumptions for returns and economic growth, those ten firms would surpass the size of the U.S. economy within a decade. That math alone stretches credulity.

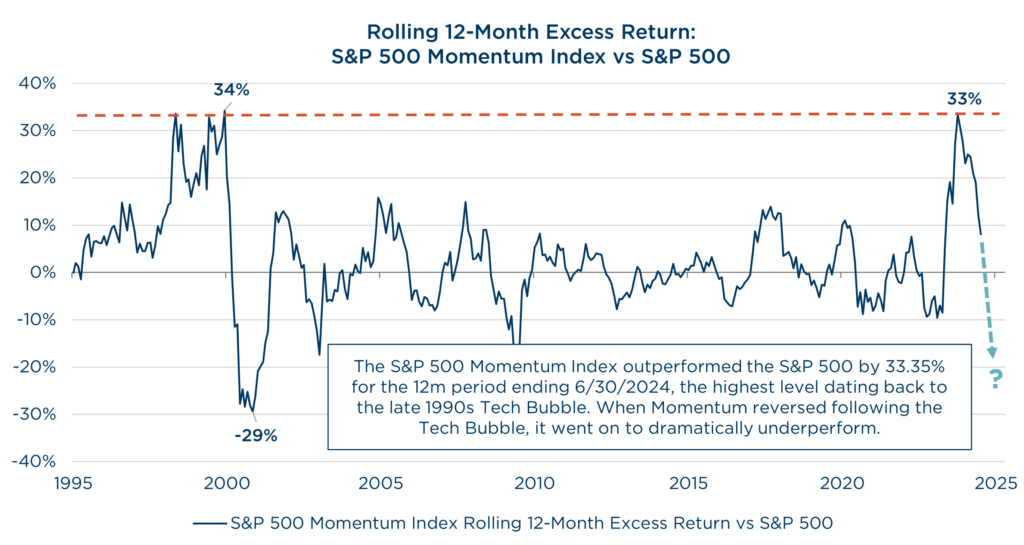

Some investors are already adjusting. The quarter saw momentum wane, while lower-volatility, dividend-oriented, and Quality factors began to assert leadership. While Momentum has since rolled over, it is still meaningfully ahead of the broad market over the trailing 12 months ending March’25. Beneath the headline indices, there’s growing evidence of a rotation away from risk-on growth and toward fundamentals that can withstand a range of outcomes. In our view, these subtle shifts hint at a market in transition: more selective, more nuanced, and more reliant on durable signals than speculative narratives.

Source: Morningstar & FactSet. Data from 9/30/1995-3/31/2025.

Strategy Recap

Our portfolios delivered varied results in the first quarter. While headline volatility favored quality and yield, not all areas of the market responded uniformly.

Our Income Equity and Large Cap portfolios delivered positive absolute returns and provided strong downside protection in a negative quarter for the core indices. In fact, Income Equity had one of its best relative quarters versus the S&P 500 since its inception. Income Equity also outperformed the Russell 1000 Value index and exceeded our 85-90% upside capture expectations. Our focus on Yield, Quality, and Lower Volatility aided relative results as high-beta and momentum names corrected.

Income Equity had one of its best relative quarters versus the S&P 500 since its inception. Our focus on Yield, Quality, and Lower Volatility aided relative results as momentum and high beta names corrected.

Performance across the Mid Cap, SMID, and Small Cap portfolios was more mixed. We benefited from our defensive, lower volatility posture, but Quality factors were somewhat muted down the market cap spectrum. The Small Cap and SMID portfolios outperformed their benchmarks in a negative quarter for the indices, though only Small Cap met our 75-80% downside capture expectations. Our Mid Cap portfolio trailed its benchmark and came up short of downside capture expectations. The strategy faced sector headwinds, plus a few idiosyncratic detractors emerged.

Our International Equity portfolio posted strong absolute results and outperformed the MSCI EAFE Index. International equities were a beneficiary of the correction in U.S. markets, and the rotation produced a strong wave that lifted all boats. The sharp index gains were powered by lower quality businesses with international banks leading the way, which created a significant headwind for our portfolio. We were encouraged to see our strategy overcome these obstacles and exceed our 85-90% upside capture expectations in a robust return environment.

Lastly, we’re excited to share that our partner, Touchstone Investments, successfully launched the Touchstone International Equity ETF (ticker TLCI) with The London Company as the subadvisor. Securing a pooled vehicle for distribution of our International Equity strategy has been nearly 18 months in the making, and we’re pleased to finally announce the good news. More information will become available in time, but please reach out to us with any questions or interest you may have.

Looking Ahead

While the recent correction may have reset some expectations, equity markets remain historically concentrated and expensive. Meanwhile, credit spreads remain tight, limiting the room for further multiple expansion and increasing the likelihood of more muted returns with greater volatility from here.

Historically, regime shifts after peak concentration can take years to fully play out, as we saw with the Nifty Fifty and the Tech Bubble. During these transitions, leadership tends to broaden. Smaller companies, value-oriented strategies, and the average stock have historically outperformed the largest names. We believe the groundwork for that shift is being laid today. Meanwhile, Quality, Yield, and Active Management tend to outperform in periods of elevated volatility and economic ambiguity.

The challenge of separating signal from noise is not a new one. In today’s volatile markets, where earnings and policy shifts drive exaggerated reactions, we focus on enduring value—competitive advantages, strong earnings, healthy balance sheets, and tangible dividends. This discipline offers clarity amid the turbulence. We remain focused on compounding the wealth of our clients by taking the long view, even when the short-term noise grows especially loud.

As always, we appreciate and highly value the trust you have placed in us.

We remain focused on compounding the wealth of our clients by taking the long view, even when the short-term noise grows especially loud.

View Our Strategies

For more information