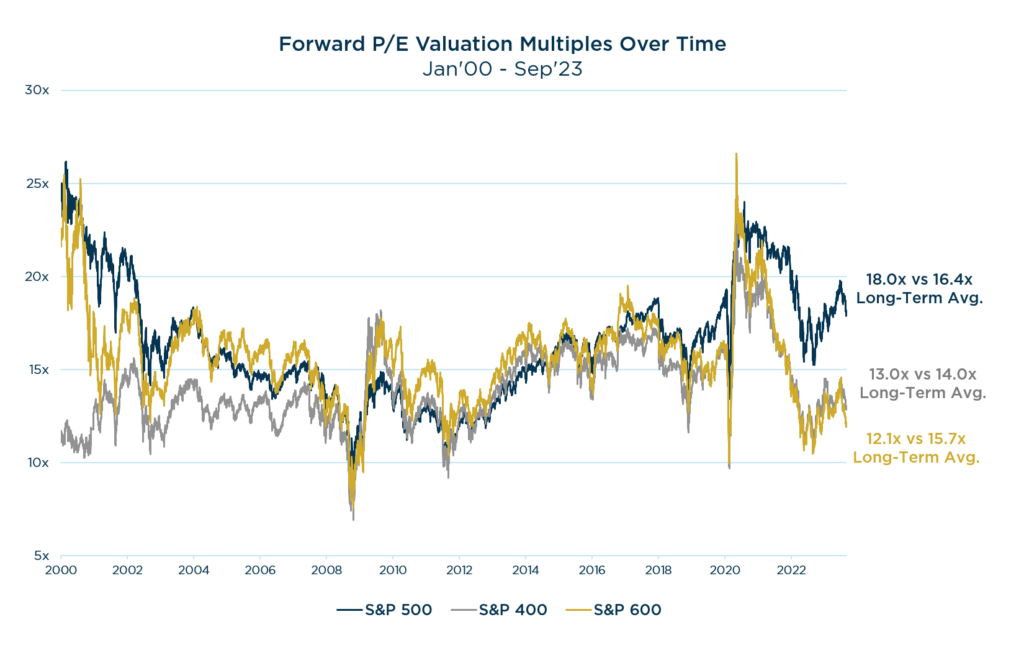

Observations Down the Market Cap Spectrum

Valuations for Small & Mid cap stocks trade at notable relative discounts to Large Caps and their respective historical averages, presenting an attractive opportunity for long-term investors.

Source: FactSet as of 9/30/2023. Past performance should not be taken as a guarantee of future results.

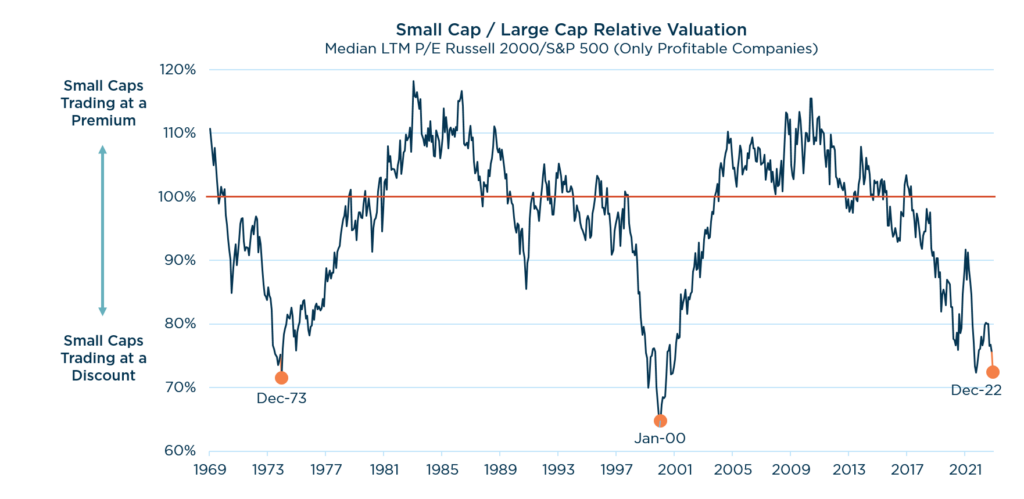

The Good News – Small Cap Valuations Appear Attractive

Looking back over the past 50+ years, valuations of Small Cap stocks relative to Large Caps are historically attractive and at levels not seen since early 2000.

Source: Furey Research Partners as of 12/31/2022. Past performance should not be taken as a guarantee of future results.

However – There Are Significant Challenges & Key Considerations

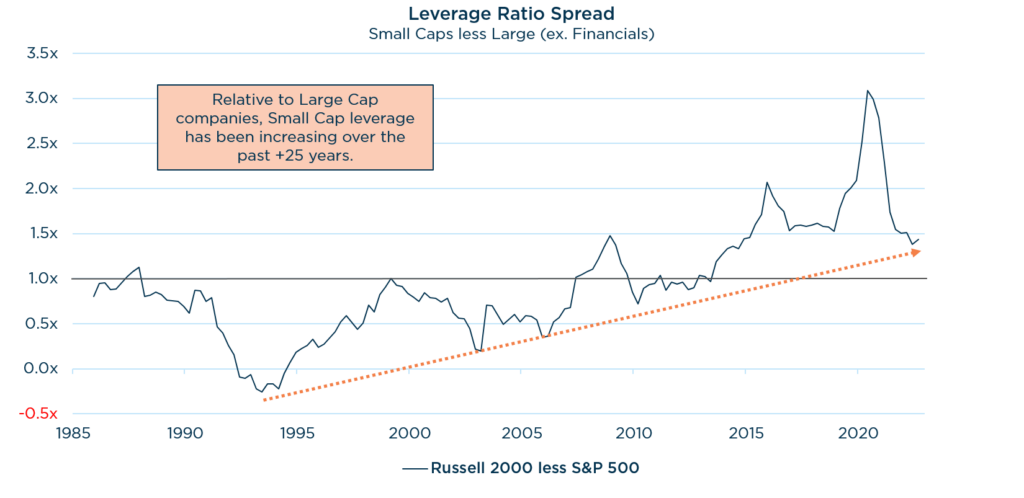

The percent of Russell 2000 companies with no earnings has risen significantly over the last decade. Additionally, quality has deteriorated, as leverage ratios have been increasing.

Source: Strategas as of 12/31/2022. Past performance should not be taken as a guarantee of future results.

Source: Furey Research Partners as of 12/31/2022. The leverage ratio represents Net Debt/EBITDA. Past performance should not be taken as a guarantee of future results.

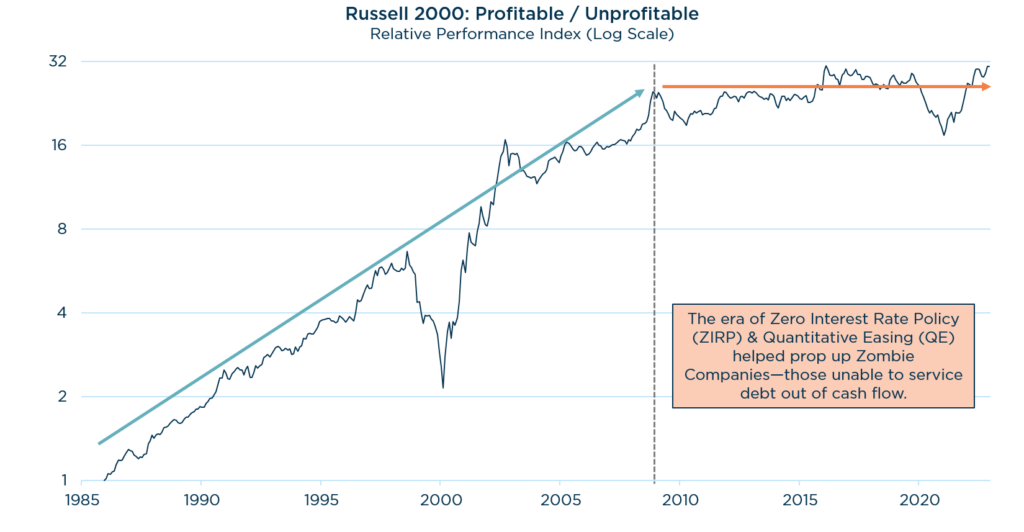

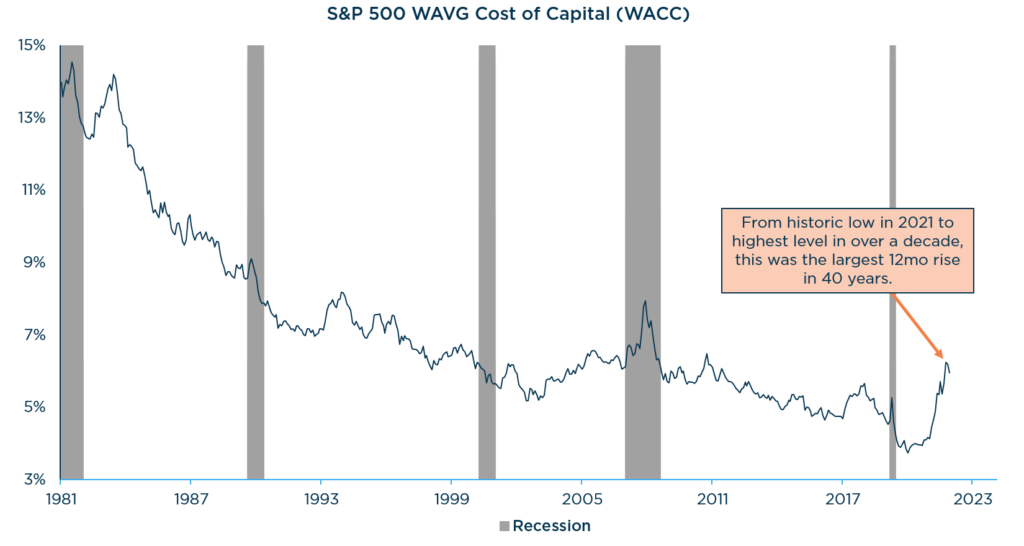

Cost of Capital in Perspective – Historical Influence & Implications Moving Forward

Over the past 10+ years, abundant access to cheap debt largely eliminated any performance differential between high and low quality Small Cap companies. That may be set to change.

Source: Furey Research Partners as of 12/31/2022. Past performance should not be taken as a guarantee of future results.

Source: Goldman Sachs as of 12/31/2022. Past Performance should not be taken as a guarantee of future results.

Now that the decade of abnormally suppressed interest rates is over, the cost of capital is on the rise AND nearly 50% of S&P 1500 debt matures in the next five years when refinancing will be much more expensive.

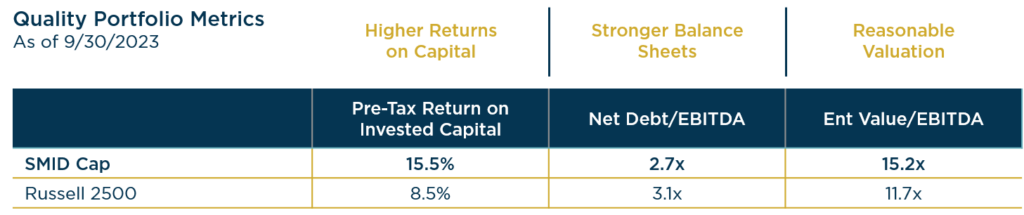

Why The London Company for SMID Cap?

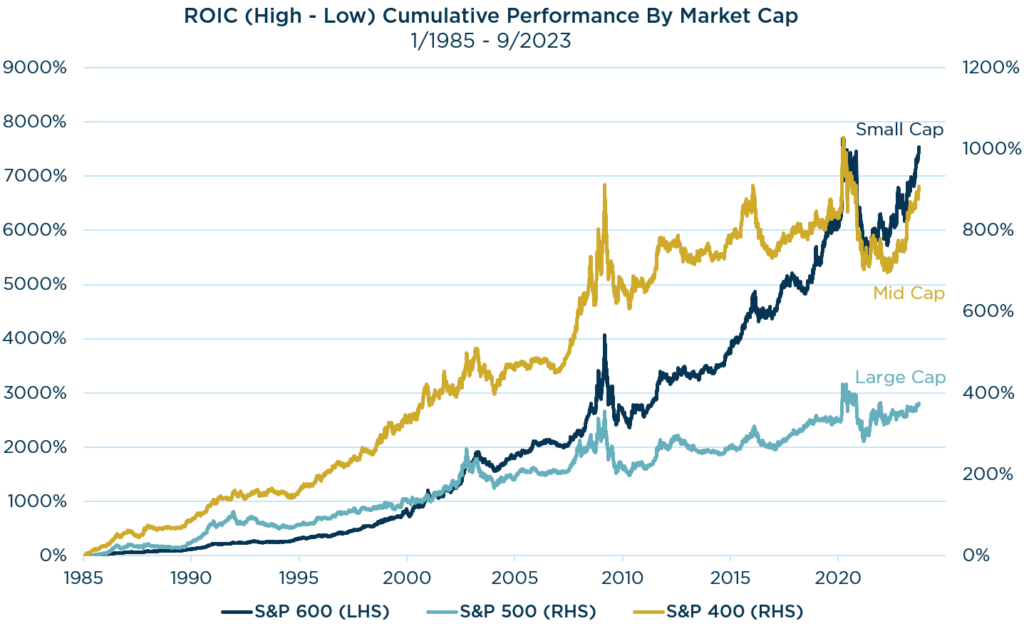

We believe our Small-Mid Cap portfolio is well positioned to capitalize on attractive relative valuations while avoiding the pitfalls associated with low-quality smaller cap companies.

- Companies with sustainably high and improving returns on capital provide downside protection and have outperformed over the long-term.

- Attributes like a strong balance sheet and the ability to self-finance operations are poised to stand out as tangible competitive advantages in a higher cost-of-capital environment.

- Pricing power allows companies to pass through inflationary costs.

Source: FactSet. Past performance should not be taken as a guarantee of future results.

Benefits of Down Cap Quality Over Time

Source: Piper Sandler as of 9/30/2023. Past performance should not be taken as a guarantee of future results.

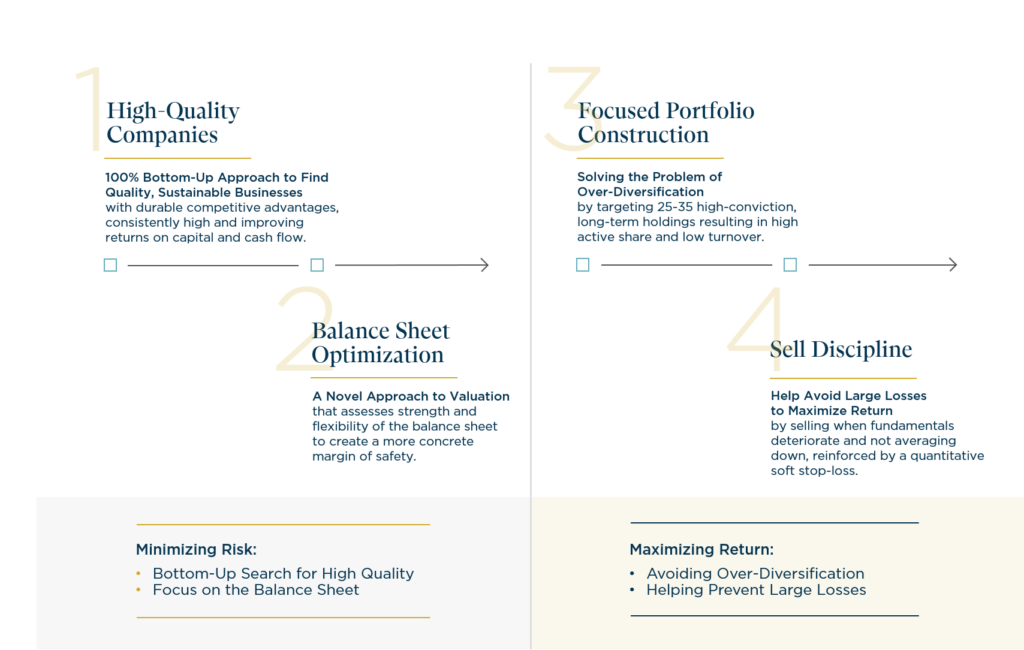

A Quality Value Approach to Small & Mid Cap Investing

Learn More about our investment philosophy.

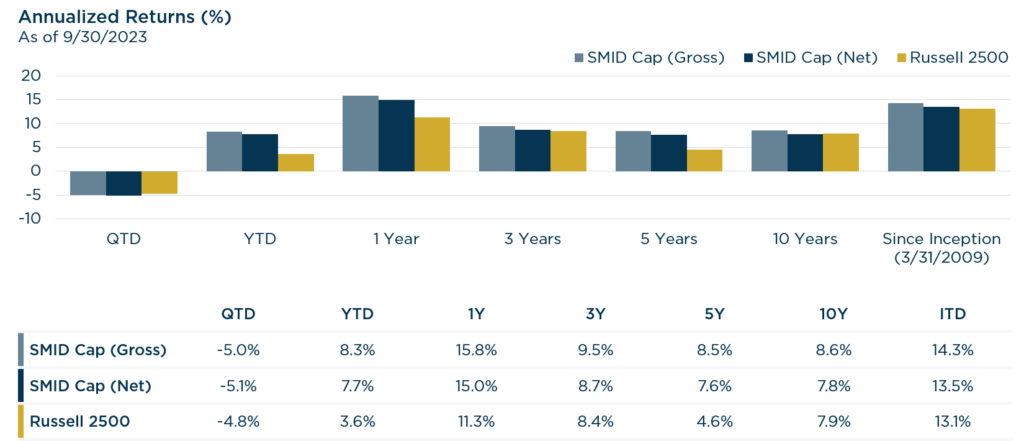

SMID Cap Performance Review

Performance shown should, under no circumstances, be construed as an indication of future performance. All are encouraged to read and understand the disclosure notes found below.

Our Investment Process