Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

- The current focus on artificial intelligence (AI) and mega-cap growth mirrors past speculative cycles, where extreme market concentration and valuation risks often led to disappointing outcomes.

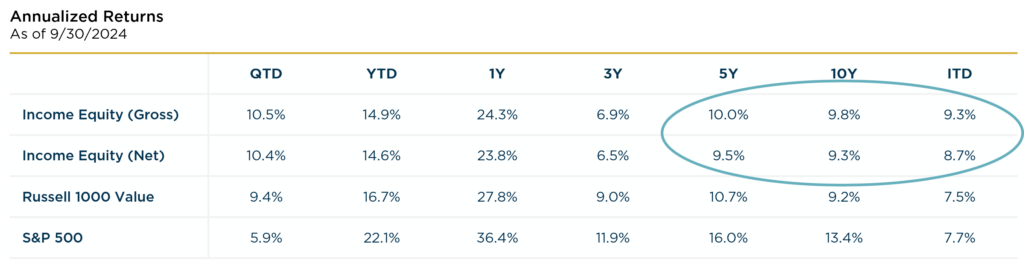

- High market concentration typically precedes leadership transitions. Our 25-year track record with the Income Equity product demonstrates the enduring value of dividends, share repurchases, and reinvested earnings—providing over 9% (8.7% net) annualized returns.

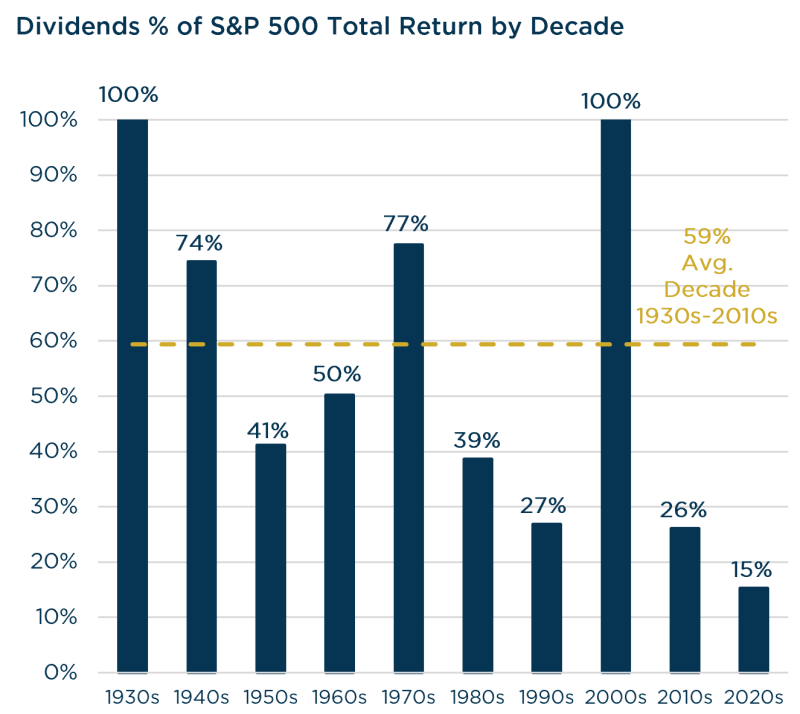

- Dividend-paying stocks, undervalued relative to the broader market, remain a compelling option for balanced investing. Dividends historically contribute significantly to returns, particularly in lower-return decades.

- By emphasizing fundamentals over fleeting trends, we advocate for a conservative, shareholder-friendly investment approach—prioritizing sustainable value creation over speculative growth.

Perspectives on the Market

The current investment environment, dominated by AI and mega-cap growth companies, has me ruminating over a classic country song, “Luckenbach, Texas (Back to the Basics of Love)” by Waylon Jennings. I’m reminded of its theme: a longing for the simplicity and authenticity of small-town life, especially in contrast to the overwhelming materialism of modern existence. This sentiment resonates deeply in today’s speculative markets, where the frenzy over a select few hyper-growth stocks, particularly in the AI sector, has overshadowed the lessons of history.

Concentration and the Case for Balance

Throughout market cycles, we’ve witnessed the same patterns emerge: extreme valuations, a narrow concentration of performance, and rampant speculation. Whether it was the Roaring Twenties, the Nifty Fifty of the 1970s, the dot-com bubble of the early 2000s, or rampant risk-taking leading up to the Global Financial Crisis, each era has shown us that the phrase “this time is different” often leads to disappointment.

Today, the U.S. equity market is near its highest level of concentration in a century, increasingly reliant on the performance of a handful of companies. Currently, the so-called “Magnificent Seven” companies represent over one third of the S&P 500’s total market capitalization. If one believes these companies will sustain their growth trajectory, it implies they could dominate the entire index within a decade—a highly improbable scenario. Yet their inflated valuations seem to reflect such an unrealistic expectation.

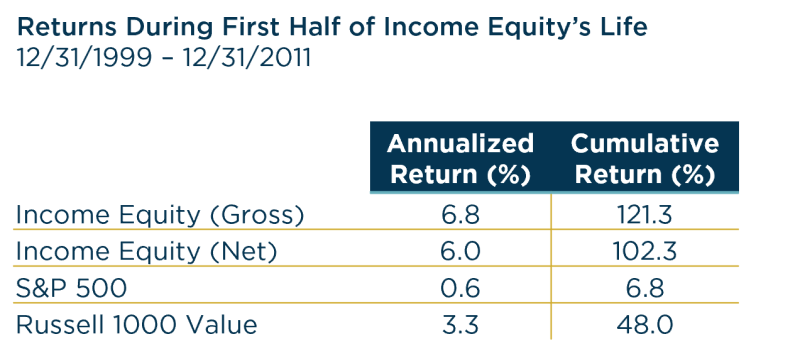

While this environment has delivered strong index returns, history shows that high market concentration often precedes leadership transitions. The inception of our Income Equity portfolio coincided with the Tech Bubble peak, the last market cycle in which index concentration reached extreme levels comparable to today’s environment. Over the ensuing 12 years, the Tech Bubble burst, there was the Global Financial Crisis and the 2011 European Debt Crisis. Our focus on quality fundamentals, downside protection and shareholder friendly virtues led to compelling relative results during a period marked by leadership transition and heightened levels of market risk.

Source: eVestment. Inception date: 12/31/1999. The Income Equity product is typically compared to the Russell 1000 Value Index. Any comparison to the S&P 500, or its corresponding ETFs, is for illustrative purposes only. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future performance.

Balance & Simplicity Win the Day

For investors, navigating these cycles requires balance and focus on what truly builds wealth—consistency over time and diligent risk management. When we launched our Income Equity product nearly 25 years ago, our goal was to offer a conservative investment product that was grounded in traditional financial virtues. A portfolio that was less reliant on speculative growth assumptions or multiple expansion to deliver compelling returns. At its core, our framework focuses on dividends, share repurchases, and reinvested earnings growth. Each component contributes to compounding returns, emphasizing fundamental, shareholder-friendly drivers of wealth creation.

While past performance doesn’t guarantee future returns, the longer-term track record of the Income Equity portfolio reflects the balance we strive to achieve with our conservative framework delivering 9%+ (8.7%+ net) annualized returns over the 5-, 10-, and since-inception periods.

Inception date: 12/31/1999. The Income Equity product is typically compared to the Russell 1000 Value Index. Any comparison to the S&P 500, or its corresponding ETFs, is for illustrative purposes only. Performance is preliminary. Subject to change. Past performance should not be taken as a guarantee of future performance.

As we look ahead, we believe concentration and valuation risks will weigh on market cap weighted indices, leading to returns that are more muted over the next decade versus the prior one. Yet, certain opportunities remain.

Dividend-paying stocks, for instance, have yet to benefit from the valuation expansions seen elsewhere, and they offer a compelling option for investors seeking more balanced, income-generating assets. Historically, dividends have been a reliable driver of absolute returns, anchoring portfolios in tangible cash flows to shareholders, even when markets send signals of uncertainty, as they do today. Since 1930, roughly 40% of the S&P 500’s total return is attributable to dividends, but that contribution typically fluctuates from 15% to over 100% over each decade. Historically, dividends have played a larger role during the decades in which annualized total returns were lower than 10%.

Source: Strategas. Data as of 8/31/2024.

‘Let’s go back to Luckenbach, Texas’

In a world captivated by the allure of rapid growth, we believe it’s time to return to the basics of investing—akin to going back to Luckenbach, Texas. While our approach may not attract the “spotlight of marquee lights,” the time-tested principles of dividends and buybacks, combined with conservative growth, can prevail even amidst the occasional irrational exuberance of the market. History supports this belief, showing that speculative booms are often followed by periods of more moderate and conservative returns. By prioritizing long-term value over fleeting trends, we can cultivate a more sustained and rewarding investment journey.

View Our Strategies

See the latest performance data