FY International Equity – 2024 vs MSCI EAFE

Market Observations & Portfolio Commentary

International Equity – 2024 vs MSCI EAFE

Full Year Market Update

Global market performance was strong but uneven in 2024, with the MSCI All Country World Index gaining 17.5%, driven by the U.S. The S&P 500 led with a 25% gain, followed by MSCI Japan at 8.3% and MSCI Europe at 1.8%. China was a standout among emerging markets, with MSCI China up 19.4% from multi-year lows. The MSCI EAFE Index returned 3.8% after a tough final quarter due to a strong U.S. dollar and policy concerns from a new administration.

Developed international markets were volatile. MSCI EAFE rose 13% in the first three quarters before an -8.1% Q4 drop. French and UK elections were market-neutral. Japan’s policy rate pivot triggered a July selloff, but markets rebounded to year highs by August. Europe and Japan gained 12-13% through Q3, but MSCI Europe fell -9.7% in Q4, led by MSCI France’s -10.3% decline, hurt by U.S. policy fears and a French tax surcharge. MSCI Japan slipped -3.6% but was less affected by U.S. policy shifts.

Financials and Industrials led the market, with Banks as the top-performing industry due to lower rates and a stable credit environment. Meanwhile, Real Estate and Utilities struggled with higher yield expectations, reversing prior gains. Materials, Consumer Staples, and Energy dragged on annual index returns. Among market factors, Yield, Size, and Momentum were positive contributors, while Volatility lagged and Value, Growth, and Quality showed mixed results. Value, Growth, and Quality factors had mixed results.

Key Performance Takeaways for the Year

-

The London Company International Equity portfolio returned 11.6% gross (10.8% net) during the year vs a return of 3.8% for the MSCI EAFE index. Stock selection was the major tailwind for relative performance, partially offset by sector exposure.

-

We were pleased to see the International Equity portfolio exceeded our upside and downside capture expectations during the year. Positive contributions from stock selection was broadly spread across Info. Technology, Materials, and the Cons. Discretionary sectors. Our underweight to Financials was a detractor to performance, but our underweights to Utilities and Real Estate were a contributor.

Top 3 Contributors to Relative Performance

-

Taiwan Semiconductor Manufacturing Co., Ltd. (TSM) – TSM was our largest contributor during the year, posting strong results with revenue and profit growth driven by AI demand. In addition, TSM is building out capacity that will underpin profitable growth over the medium-term. TSM has expanded its leadership position, now benefiting from a near monopoly advantage in leading edge chips. A net cash balance sheet supports downside protection, while TSM’s high returns on capital and favorable exposure to structural growth offer attractive upside potential over the long-term.

-

SAP SE (SAP GY) – Inflecting cloud enterprise software growth led to strong performance in SAP shares over the year. SAP, a leading enterprise software company, has invested heavily to transition its business from on-premise to the cloud which has depressed margins and obfuscated revenue growth trends. SAP is now leveraging those investments, and the drag from licensing revenue declines continues to abate. SAP is seeing higher revenue growth and margin expansion, as the company leverages fixed costs. We believe that SAP shares remain attractive at reasonable valuation on depressed margins with predictable, stable revenue growth.

-

CRH PLC (CRH) – Our thesis on CRH continued to materialize throughout 2024. CRH raised guidance despite fears of sector-wide, macro-driven headwinds and continues to demonstrate the durability of its competitive position through pricing power and high returns on capital. We remain constructive on the business as its dominant market positions in high-growth markets, unique focus on integrated solutions, strong balance sheet, and shareholder friendly capital allocation position the business well for the future.

Top 3 Detractors from Relative Performance

-

Akzo Nobel (AKZA NA) – AKZA battled anemic volumes and input cost pressures leading to disappointing results. Despite multiple restructurings, the company hasn’t delivered the sustained volume or profit growth we would have expected at this point and hasn’t tracked to our original thesis. While the valuation appears optically cheap, we decided to exit the position and reallocate the capital to opportunities where we have more confidence.

-

Canadian National Railway Company (CNR CN) – In addition to low industrial production, manufacturing activity and tepid consumer demand, CNR faced challenges including labor union negotiations and network disruptions due to wildfires in 2024. While these challenges are transitory in nature, they forced the company to revise its medium-term outlook, and shares were pressured as a result. We believe the stock’s current valuation offers an attractive risk/reward for long-term investors and CNR’s balance sheet supports downside protection.

-

ICON, PLC (ICLR US) – ICLR is a leading provider of clinical research services to the pharmaceutical industry. Shares were pressured in the second half of the 2024 as a confluence of challenges including trial cancellations, delays, and ongoing budget cuts at two of its largest customers, on top of a soft biotech funding backdrop, led to a revenue shortfall and a subsequent guidance reduction. Many of these challenges are sector wide, and some are idiosyncratic. The company has gained share as peers contend with similar challenges and remains advantaged in its incumbency as a top vendor to sponsors with the largest R&D budgets. We are encouraged by management actions including an acceleration of its share repurchase program as the stock trades near all-time low valuation levels. The company remains attractive as a low-capital intensity, high returns business with a compelling valuation and strong balance sheet.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight Energy, Health Care, & Consumer Discretionary (weaker performing sectors) & Overweight Industrials (a better performing sector)

-

What Hurt: Underweight Financials (a better performing sector) & Overweight Materials and Consumer Staples (weaker performing sectors)

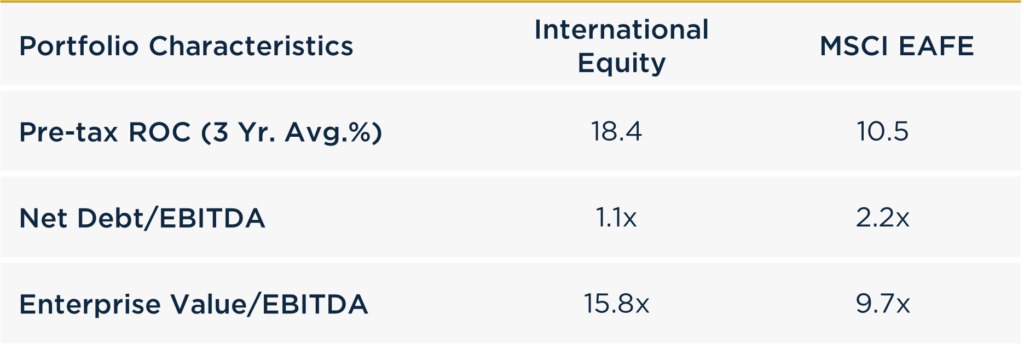

Portfolio Characteristics & Positioning

We believe the International Equity portfolio is positioned for long-term durability and possesses the fundamental ingredients that stand the test of time: wide moats, sustainable high return on capital, strong free cash flow generation, low leverage ratios and shareholder focused management teams. The portfolio trades at a premium to the MSCI EAFE index, but we believe this is justified as companies in the index have lower returns on capital and higher leverage.

As a corporate debt maturity wall approaches and the cost of that capital stays elevated, we believe companies with strong balance sheets and the ability to self-fund their operations could have a structural advantage in 2025 and beyond. In an environment of possibly lower returns and greater volatility, we believe the International Equity portfolio offers an attractive option for equity investors.

Source: FactSet

Looking Ahead

From an economic perspective, we expect a generally positive direction in economic data points with global inflation easing along with policy rates globally in most developed market economies, outside of Japan. While the general backdrop is positive, populist movements in the U.S. and abroad bears close attention due to increased risk of cross-border trade skirmishes and change in the global inflation trajectory. As we stated in our last update and worth repeating, we don’t rely on predicting or timing macroeconomic outcomes. Longer-term, we operate with the expectation of modest economic growth with our focus at the individual company level.

In terms of equities, while the U.S. market valuation is stretched, we observe that valuations outside U.S. are more reasonable compared to history and should be broadly supportive of equity returns going forward. The companies we own are high-quality businesses run by good management teams with conservative balance sheets at attractive valuations. We believe the resulting portfolio will serve our investors well through a full market cycle. We continue to expect that our quality value approach will lead to strong risk-adjusted returns protecting in the inevitable down markets while participating in up markets.

We believe the International Equity portfolio is positioned for long-term durability and possesses the fundamental ingredients that stand the test of time.

Annualized Returns

As of 12/31/2024

Inception date: 9/30/2023. Past performance should not be taken as a guarantee of future results. Performance is preliminary. Subject to change.