Market Observations & Portfolio Commentary

Large Cap – 4Q2024 vs. Russell 1000

Market Update

U.S. equities traded higher during 4Q, with most of the major indices posting positive gains. Economic data released during the quarter were positive, but choppy. The Fed’s monetary policy continued on a less restrictive path, but shifted a bit more hawkish in December reflecting higher than desired inflation, a strong labor market and better-than-expected GDP growth in recent quarters. The more hawkish view from the Fed led investors to assume fewer rate cuts in the months ahead. The broader market, measured by the Russell 3000 Index, rose 2.6%. Similar to earlier in the year, larger companies with attractive growth profiles led the market. Looking at market factors, Growth, Volatility, and Momentum posted the strongest returns, while Value, Yield, and most Quality factors presented headwinds.

Key Performance Takeaways

-

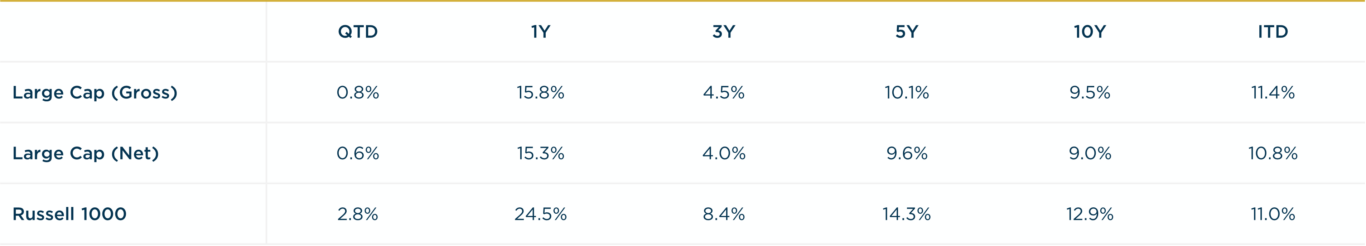

The London Company Large Cap portfolio returned 0.8% (0.6% net) during the quarter vs. a 2.8% increase in the Russell 1000 Index. Stock selection was a headwind to relative performance, partially offset by positive sector exposure.

-

The Large Cap portfolio trailed its benchmark and lagged our expectations of 85-90% upside capture. Having limited exposure to Growth, Volatility, and Momentum factors and greater exposure to Quality and Yield factors were headwinds to relative performance. The concentration of the Index in a handful of companies was an additional headwind. Our portfolios often lag during risk-on environments or when stocks compound at double-digit annual rates.

-

We continue to believe that Quality factors will add value over full cycles. Our focus on high returns on capital, balance sheet strength, and valuation helps to reinforce our margin of safety and positions our Large Cap portfolio for success in this uncertain climate.

Top 3 Contributors to Relative Performance

-

Alphabet Inc. (GOOG) – GOOG was a top performer this quarter reflecting strong results from its ad business, Cloud growth, and margin enhancements. Investors got some clarity on the antitrust lawsuits during the quarter, but potential outcomes from these cases remain uncertain. Margins in the core business continue to improve, and growth in the Cloud business accelerated. Management has executed its expense control plans and expanded margins through better product and process organization. GOOG has a solid balance sheet, significant market share, and generates strong returns on invested capital.

-

Fiserv, Inc. (FI) – FI delivered another strong quarter, executing well on company initiatives. Merchant revenue growth remains strong, driven by Clover’s notable market share gains through strong distribution, new product launches, and higher attach rates for value-added services. The Financial segment continues to show resilient growth, leveraging digital payments and effective cross selling to expand customer wallet share across segments. Free cash flow generation remains strong with management focusing on organic reinvestment and capital returns. We are confident in FI’s ability to deliver sustainable earnings growth through its strong product portfolio and disciplined capital allocation.

-

Visa Inc. (V) – V’s competitively advantaged and resilient business model makes it a steady compounder. The stock price rallied a bit in November following the election as antitrust enforcement may be looser under the new administration. This is relevant for V’s who is currently facing an antitrust case from the Department of Justice (filed in September), and regularly engages in acquisitions to grow.

Top 3 Detractors from Relative Performance

-

Nestle S.A. (NSRGY) – NSRGY shares underperformed the broader market all year. Sentiment across the packaged food space is low as it emerges from two years of unprecedented food price inflation. NSRGY’s latest earnings report did not suggest an acceleration in organic growth from current subdued trends. NSRGY’s portfolio is attractively positioned in categories that have stable, long-term volume tailwinds such as coffee, pet food, and nutritional health. Barring further executional missteps, we believe the downside to the current stock price is low.

-

Progressive Corporation (PGR) – PGR was a weaker performer in 4Q after a strong start to the year. Policy growth continued to be strong, but expectations were high and growth decelerated slightly throughout the quarter. That said, retention has remained high, and share gains continue. PGR’s best-in-class market segmentation gives preferred drivers lower rates, leaving competitors with worse drivers and more erratic pricing strategies. We remain attracted to its best-in-class operations, conservative underwriting, and shareholder-friendly capital allocation philosophy.

-

Texas Instruments Incorporated (TXN) – Shares of TXN underperformed during 4Q. While the company continues to execute its long-term capital investment plan and is seeing stabilizing end markets, the market continues to focus on gross margins that are depressed by near-term investment ahead of revenue. Additionally, the market is currently rewarding other parts of the technology sector. Our confidence in TXN and its ability to grow shareholder value is undeterred.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight Health Care (a weaker performing sector) & overweight Financials (a better performing sector)

-

What Hurt: Overweight Materials (a weaker performing sector) & underweight Info. Technology (a better performing sector)

Trades During the Quarter

-

Exited: Pfizer (PFE) – Sale reflects concerns around recent acquisitions and potential holes in the company’s drug pipeline. We also note possible regulatory headwinds.

-

Exited: CarMax (KMX) – Sale reflects our lack of conviction in management’s ability to navigate a potentially more challenging consumer environment while balancing the demands of investment in omni-channel capabilities. Separately, the auto finance business represents over 50% of company earnings and there is risk of rising potential losses.

-

Initiated: Bruker (BRKR) – BRKR designs and manufactures advanced scientific instruments as well as analytical and diagnostic solutions for a number of differentiated end markets in the life sciences arena. Its solutions enable its customers to explore life and materials at microscopic, molecular and cellular levels. With a global presence and a focus on life sciences, it benefits from long-term drivers like proteomics research. BRKR derives its competitive moat from its highly innovative instruments that push the cutting edge of science, enabling strong pricing power and market leadership. BRKR’s management team has an excellent track record of capital allocation and delivering on their promises that help create shareholder value. Over time, BRKR has reduced its reliance on government/academic customers, diversified away from Europe, increased growth, and expanded margins meaningfully. BRKR also possesses many characteristics we look for in a company, including a strong balance sheet, high ROIC (>20%), improving margin (close to 20%), and high inside ownership. We already own BRKR in our the SMID and Mid Cap portfolios.

Looking Ahead

As we enter 2025, we believe the market faces an inflection point where sustaining momentum becomes increasingly difficult. Across the real economy, demand still seems sluggish and clear late-cycle signals persist. Revenue growth and corporate profits have leaned on inflationary pricing, but margins face growing headwinds as inflationary pricing fades, input costs rise, and demand softens. The Fed cut rates during 2024, but the yields on longer-dated treasuries actually rose as the year ended. Stubbornly high borrowing costs continue to plague rate-sensitive areas of the economy, like housing. Employment and inflation data may be volatile in 2025 and could affect changes in monetary policy and lead to greater volatility across equity markets.

Despite resilient economic data and limited signs of credit risk, we believe vigilance is warranted. Our cautious posture persists due to high valuations, market concentration, looming debt challenges, and fraying consumer health. We anticipate lower expected returns in the near term, based on slowing growth (function of restrictive monetary policy) and high valuations. Valuation multiple expansion can only take the market so far (particularly late in a market cycle). We expect a reversion to the mean whereby earnings growth & dividends drive returns going forward. While optimism remains high, the vulnerabilities of momentum-driven leadership highlight the need for discipline. Markets may reward risk-taking in the short term, but lasting wealth is built through patience, real income, and fundamentals.

Our focus on high returns on capital, balance sheet strength, and valuation helps to reinforce our margin of safety and positions the Large Cap portfolio for success in this uncertain climate.

Annualized Returns

As of 12/31/2024

Inception date: 6/30/1994. Past performance should not be taken as a guarantee of future results. Performance is preliminary. Subject to change.