Market Observations & Portfolio Commentary

Small Cap – 4Q2024 vs. Russell 2000

Market Update

U.S. equities traded higher during 4Q, with most of the major indices posting positive gains. Economic data released during the quarter were positive, but choppy. The Fed’s monetary policy continued on a less restrictive path, but shifted a bit more hawkish in December reflecting higher than desired inflation, a strong labor market and better-than-expected GDP growth in recent quarters. The more hawkish view from the Fed led investors to assume fewer rate cuts in the months ahead. The broader market, measured by the Russell 3000 Index, rose 2.6%. Similar to earlier in the year, larger companies with attractive growth profiles led the market. Looking at market factors, Growth, Volatility, and Momentum posted the strongest returns, while Value, Yield, and most Quality factors presented headwinds.

Key Performance Takeaways

-

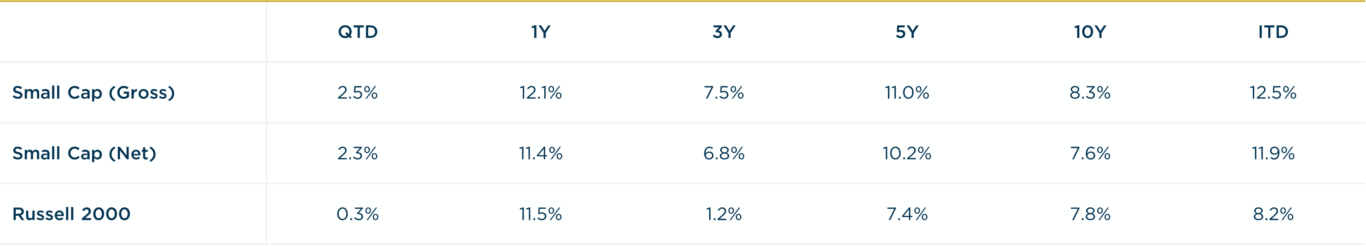

The London Company Small Cap portfolio increased 2.5% (2.3% net) during the quarter vs. a 0.3% increase in the Russell 2000 Index. Both sector exposure and stock selection had a positive impact on relative performance.

-

The Small Cap portfolio outperformed its benchmark and exceeded our 85-90% upside capture expectations during 4Q. Strong performance of select names and underweights to two of the weakest sectors of the index (e.g. Energy & Health Care) drove solid relative results.

-

We continue to believe that Quality factors will add value over full cycles. Our focus on high returns on capital, balance sheet strength, and valuation helps to reinforce our margin of safety and positions our Small Cap portfolio for success in this uncertain climate.

Top 3 Contributors to Relative Performance

-

Revolve Group, Inc (RVLV) – RVLV appreciated 35% during 4Q after reporting sequential improvement in sales growth and continued progress on restoring margins. Nearly all key performance indicators are trending in the right direction and management execution has been strong. RVLV is staying abreast of industry developments and thoughtfully pursuing reinvestment opportunities with an eye to the long term. Our conversations with management throughout the year confirm this thesis.

-

White Mountains Insurance Group Ltd (WTM) – WTM reported solid quarterly earnings, attributable to growth in their Ark/Outrigger underwriting results, which reported an excellent 77% combined ratio with favorable prior year developments despite a major Atlantic hurricane landfall. As a result, book value per share continued to increase. We remain confident in management’s ability to deliver outsized growth in book value per share over time through prudent capital allocation.

-

Gates Industrial Corporation Plc (GTES) – GTES continues to execute effectively on cost management, driving notable profitability improvements. Its diversified portfolio and significant replacement mix provide earnings stability and downside protection, with growth in replacement channels driving overall performance. A strong margin profile and low capital requirements continue to support robust free cash flow generation and high returns on capital. GTES is well positioned for above-market growth and margin expansion by leveraging trends like electrification and chain-to-belt retrofitting, alongside ongoing cost improvements and productivity gains, reinforcing our confidence in the investment thesis.

Top 3 Detractors from Relative Performance

-

ePlus Inc. (PLUS) – PLUS was one of the weaker holdings during 4Q after reporting results below expectations, reflecting weak networking hardware sales and lowered FY25 guidance. Despite the softer hardware demand, PLUS is delivering on the growth of its services businesses, which is positive for margin and stability. PLUS has an under-levered balance sheet and attractive opportunities to deploy cash into accretive tuck-ins or share repurchases.

-

Landstar System, Inc. (LSTR) – LSTR faced challenges in 4Q due to a continued soft spot freight environment, driven by lingering weakness in the U.S. manufacturing sector. Loose truck capacity also contributed to lower volumes and revenue. Despite challenges, LSTR maintained a strong balance sheet and continued to return capital to shareholders through dividends and share repurchases. We remain attracted to Landstar reflecting its variable cost business model, which we believe can limit downside in the shares.

-

Essential Properties Realty Trust, Inc. (EPRT) – EPRT lagged in 4Q as REITs underperformed the market. In our view, this underperformance was driven primarily by interest rates as inflation expectations and the 10-year treasury yield increased. We do not believe underperformance in the quarter was related to company fundamentals. EPRT continues to execute well on sourcing deals, managing credit, and maintaining a conservative balance sheet.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Underweight Health Care (a weaker performing sector) & overweight Info. Technology (a better performing sector)

-

What Hurt: Overweight in both Real Estate and Consumer Discretionary (weaker performing sectors)

Trades During the Quarter

-

Exited: Innovex International, Inc. (INVX) – Sold the remaining position after the company merged with Dril-Quip. It was a very small position (less than 0.5%)

-

Increased: Lancaster Colony Corporation (LANC) – Addition reflects conviction in long-term thesis and we remain encouraged by continued growth with sauces at Chick-fil-A.

Looking Ahead

As we enter 2025, we believe the market faces an inflection point where sustaining momentum becomes increasingly difficult. Across the real economy, demand still seems sluggish and clear late-cycle signals persist. Revenue growth and corporate profits have leaned on inflationary pricing, but margins face growing headwinds as inflationary pricing fades, input costs rise, and demand softens. The Fed cut rates during 2024, but the yields on longer-dated treasuries actually rose as the year ended. Stubbornly high borrowing costs continue to plague rate-sensitive areas of the economy, like housing. Employment and inflation data may be volatile in 2025 and could affect changes in monetary policy and lead to greater volatility across equity markets.

Despite resilient economic data and limited signs of credit risk, we believe vigilance is warranted. Our cautious posture persists due to high valuations, market concentration, looming debt challenges, and fraying consumer health. We anticipate lower expected returns in the near term, based on slowing growth (function of restrictive monetary policy) and high valuations. Valuation multiple expansion can only take the market so far (particularly late in a market cycle). We expect a reversion to the mean whereby earnings growth & dividends drive returns going forward. While optimism remains high, the vulnerabilities of momentum-driven leadership highlight the need for discipline. Markets may reward risk-taking in the short term, but lasting wealth is built through patience, real income, and fundamentals.

Our focus on high returns on capital, balance sheet strength, and valuation helps to reinforce our margin of safety and positions the Small Cap portfolio for success in this uncertain climate.

Annualized Returns

As of 12/31/2024

Inception date: 9/30/1999. Past Performance should not be taken as a guarantee of future results. Performance is preliminary. Subject to change.