Market Observations & Portfolio Commentary

SMID Cap – 4Q2024 vs. Russell 2500

Market Update

U.S. equities traded higher during 4Q, with most of the major indices posting positive gains. Economic data released during the quarter were positive, but choppy. The Fed’s monetary policy continued on a less restrictive path, but shifted a bit more hawkish in December reflecting higher than desired inflation, a strong labor market and better-than-expected GDP growth in recent quarters. The more hawkish view from the Fed led investors to assume fewer rate cuts in the months ahead. The broader market, measured by the Russell 3000 Index, rose 2.6%. Similar to earlier in the year, larger companies with attractive growth profiles led the market. Looking at market factors, Growth, Volatility, and Momentum posted the strongest returns, while Value, Yield, and most Quality factors presented headwinds.

Key Performance Takeaways

-

The London Company Small-Mid Cap portfolio returned 1.9% (1.7% net) during the quarter vs. a 0.6% increase in the Russell 2500 Index. Both sector allocation and stock selection were tailwinds to relative performance.

-

The SMID portfolio outperformed its benchmark and exceeded our 85-90% upside capture expectations during 4Q. Strong performance from several holdings plus some benefit from Quality factors drove solid relative results.

-

We continue to believe that Quality factors will add value over full cycles. Our focus on high returns on capital, balance sheet strength, and valuation helps to reinforce our margin of safety and positions our SMID portfolio for success in this uncertain climate.

Top 3 Contributors to Relative Performance

-

Deckers Outdoor Corporation (DECK) – DECK manages top brands in the footwear industry and has outperformed other retailers for several years. UGG and HOKA are benefitting from brand heat, and management remains focused on thoughtfully acquiring and retaining customers. The most recent earnings report in October showed that HOKA doubled sales in only two years (off a $1B base), which has helped to diversify the seasonality of DECK and expand margins. UGG also continues to defy expectations and is growing quite nicely in both its on- and off-seasons.

-

White Mountains Insurance Group Ltd (WTM) – WTM reported solid quarterly earnings, attributable to growth in their Ark/Outrigger underwriting results, which reported an excellent 77% combined ratio with favorable prior year developments despite a major Atlantic hurricane landfall. As a result, book value per share continued to increase. We remain confident in management’s ability to deliver outsized growth in book value per share over time through prudent capital allocation.

-

Armstrong World Industries, Inc. (AWI) – AWI outperformed as the company continues to exhibit strong sales and earnings growth amidst muted market conditions. Markets are beginning to stabilize and should return to low single digit growth, with the recovery led by new construction, renovation, and growth initiatives. Positive trends in transportation, education, healthcare, and data centers gives us confidence that the company will continue to execute.

Top 3 Detractors from Relative Performance

-

Entegris, Inc. (ENTG) – ENTG underperformed during 4Q due to a more sluggish market recovery, particularly in mainstream and 3D NAND areas, as well as providing a cautious outlook. That said, its solutions for advanced technology and incremental wafer content gains should propel a faster recovery next year. ENTG is one of the most diversified players in the semi-materials industry with its size and scale. We remain attracted to the industry’s high barriers to entry, limited competitors, and high switching costs.

-

Bruker Corporation (BRKR) – BRKR shares lagged the broader market following a weaker than expected earnings report, where revenue missed consensus estimates and management cut guidance. The latter was attributable to the same culprits afflicting the broader life sciences tools space – China and biopharma. On a positive note, the CEO purchased shares on weakness, which helped boost sentiment. While we acknowledge the near-term uncertainty around the stock due to macro headwinds and recent acquisitions, we have conviction around the company’s favorable long-term prospects.

-

Reynolds Consumer Products Inc (REYN) – REYN was one of the weaker holdings during 4Q as it continues to navigate headwinds in a challenging consumer environment. While demand for its products improved throughout the quarter, its tableware foam business was a big drag due to legislative changes and lower pricing. The private label business and the shift to at-home consumption continue to help drive REYN volume. Management has prioritized debt pay down and its free cash flow is growing.

Sector Influence

We are bottom-up stock pickers, but sector exposures influenced relative performance as follows:

-

What Helped: Overweight in Consumer Staples (better performing sector) & underweight Health Care (weaker performing sector)

-

What Hurt: Underweight in both Energy & Financials (two better performing sectors)

Trades During the Quarter

-

Reduced: Deckers Outdoor (DECK) – Trimmed on strength. After a multi-year run, its valuation is elevated. The UGG and HOKA brands remain strong.

-

Exited: CarMax (KMX) – Sale reflects our lack of conviction in management’s ability to navigate a potentially more challenging consumer environment while balancing the demands of investment in omni-channel capabilities.

-

Exited: Martin Marietta (MLM) – Sold due to size. Market capitalization now exceeds $35B.

-

Exited: Perrigo (PRGO) – Sold due to poor execution & the retirement of CEO Murray Kessler, who couldn’t turn around the business as we expected.

-

Initiated: Credit Acceptance Corp. (CACC) – CACC provides dealer financing programs, enabling automobile dealers to sell vehicles to consumers with poor credit. Operating as a lender of last resort, CACC serves a critical role for a large cohort of borrowers. CACC’s competitive advantage lies in its 50-year track record, partnerships with over 10,000 dealers, and robust data models that predict loan defaults with remarkable accuracy. Recent challenges from 2021-2022 loan vintages are improving as stronger 2023-2024 loans gain traction. Rising interest rates and reduced competition are driving double-digit growth in market share. Trading at a 12% earnings yield with a strong balance sheet, CACC offers a compelling risk/reward backed by decades of consistent profitability and shareholder-focused management.

-

Initiated: CCC Intelligent Solutions (CCCS) – CCCS provides software solutions for the property and casualty insurance industry, with a focus on automotive claims. Its platform connects repair shops, parts suppliers, and insurers, processing over $100 billion in annual claims data. CCCS commands a dominant market share, handling over 80% of U.S. auto claims, and leverages scale, network effects, and high customer retention to maintain its competitive edge. With a SaaS-based model, CCCS drives durable growth, strong margins, and recurring revenues.

-

Initiated: Element Solutions (ESI) – ESI is a specialty chemicals producer serving electronics and industrial markets. Electronics is ESI’s primary growth engine, supported by content growth in circuit boards, semiconductors, and EV markets. A variable cost structure and sticky, spec’d-in products bolster earnings stability across cycles. ESI offers consistent cash flow and benefits from strong capital allocation led by management aligned with long-term incentives. More recently, management has been divesting non-core assets and reinvesting back into its growth segments. Trading at an attractive discount to intrinsic value, we believe ESI offers upside from a recovering electronics cycle, margin expansion from improved product mix, and pricing power due to high customer switching costs.

Looking Ahead

As we enter 2025, we believe the market faces an inflection point where sustaining momentum becomes increasingly difficult. Across the real economy, demand still seems sluggish and clear late-cycle signals persist. Revenue growth and corporate profits have leaned on inflationary pricing, but margins face growing headwinds as inflationary pricing fades, input costs rise, and demand softens. The Fed cut rates during 2024, but the yields on longer-dated treasuries actually rose as the year ended. Stubbornly high borrowing costs continue to plague rate-sensitive areas of the economy, like housing. Employment and inflation data may be volatile in 2025 and could affect changes in monetary policy and lead to greater volatility across equity markets.

Despite resilient economic data and limited signs of credit risk, we believe vigilance is warranted. Our cautious posture persists due to high valuations, market concentration, looming debt challenges, and fraying consumer health. We anticipate lower expected returns in the near term, based on slowing growth (function of restrictive monetary policy) and high valuations. Valuation multiple expansion can only take the market so far (particularly late in a market cycle). We expect a reversion to the mean whereby earnings growth & dividends drive returns going forward. While optimism remains high, the vulnerabilities of momentum-driven leadership highlight the need for discipline. Markets may reward risk-taking in the short term, but lasting wealth is built through patience, real income, and fundamentals.

Our focus on high returns on capital, balance sheet strength, and valuation helps to reinforce our margin of safety and positions the SMID Cap portfolio for success in this uncertain climate.

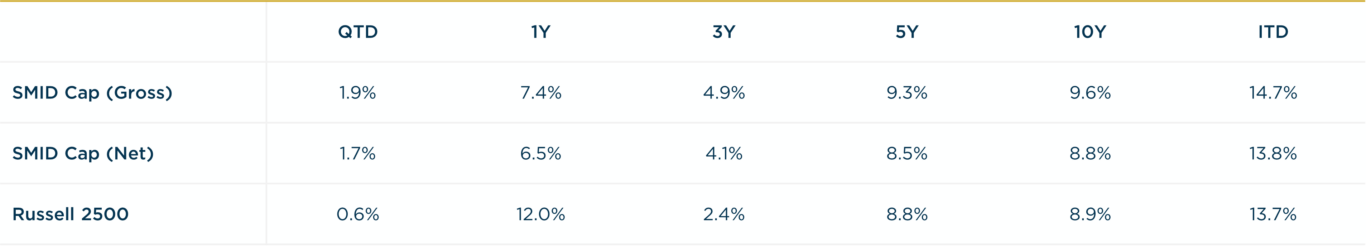

Annualized Returns

As of 12/31/2024

Inception date: 3/31/2009. Past performance should not be taken as a guarantee of future results. Performance is preliminary. Subject to change.