Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

- Risk-taking is fundamental to progress, but the line between investing & gambling has become blurred the last few years.

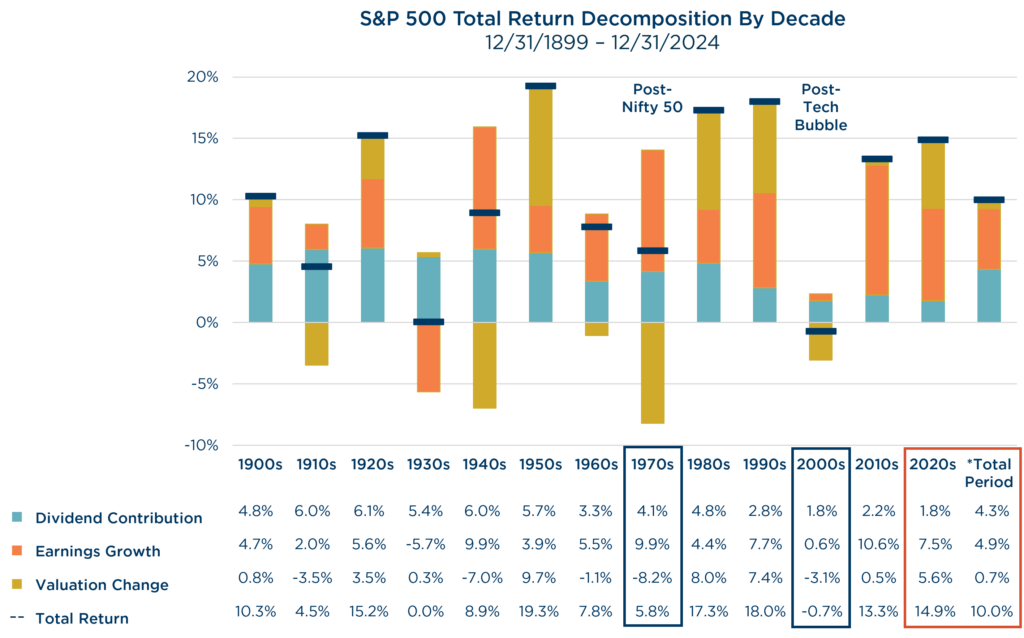

- Multiple expansion has been a driving force behind the recent stretch of robust market returns. History shows, however, that earnings and dividends contribute most to long-term gains. P/E multiples tend to mean revert, making valuation expansion an unreliable source of sustained performance.

- Today’s market bears some resemblance to the Nifty 50 and Tech Bubble eras. Periods where a momentum-fueled move in a small segment of the stocks created a concentrated and overvalued market, which ultimately led to muted long-term returns the following decade.

- Long-term success relies on earnings, dividends, and reasonable valuations—not speculation or luck. A disciplined, fundamentals-driven approach remains the best way to stack the odds in our favor.

Perspectives on the Market

Risk-taking is as American as apple pie. From the pioneers crossing the frontier to today’s speculators betting on the Super Bowl, we have a long history of embracing uncertainty. Yet, lately the risk-taking has been getting out of hand, and the line between investing and gambling has become blurred in recent years.

Investing is one of the most effective ways to take calculated risks, but unlike gambling, it allows us to stack the odds in our favor. It’s built on fundamental economic factors that, over time, drive returns.

The Fragility of Multiple Expansion

When it comes to long-term investing, earnings and dividends are your bread and butter. History shows that P/E multiples can give your returns a temporary boost, but they tend to mean revert over time. This makes valuation expansion an unreliable driver of sustained performance in the long run.

Recently, multiple expansion has been a significant component of returns. The S&P 500 has compounded at 15% annually over the past five years, well above its long-term average, largely due to rising P/E ratios rather than broad-based, fundamental growth.

Source: Strategas, Professor Robert J. Shiller Dataset. Data from 12/31/1899 – 12/31/2024. *Total Period figures include 2024 data. Strategas calculated total return, valuation-change, earnings growth, and dividend contribution. Rates are expressed in percent and are annualized. Past performance should not be taken as a guarantee of future performance.

Importantly, momentum-driven markets often mask underlying fragility. While rising valuations can be self-reinforcing for a time, history teaches us that when ‘the music stops’ and sentiment shifts, multiple expansion can unwind rapidly. The higher the valuation, the bigger the fall could be. Investors who ignore this might confuse short-term betting with long-term investing.

Nifty 50 Parallel: When Complacency Becomes the Bet

A quick look at history offers a cautionary tale. The Nifty 50 stocks of the late 1960s and early 1970s were seen as invincible. Coca-Cola, IBM, and Disney could do no wrong—until they did. When sentiment shifted, high valuations came back down to earth, leaving investors who ignored fundamentals nursing their wounds. The Tech Bubble of the late ‘90s told a similar story. The lesson is clear: even great companies can be poor investments if you overpay for them.

Today, we see echoes of these past eras. A concentrated group of stocks—the “Magnificent 7” and a handful of AI darlings—have done most of the heavy lifting for the market, much like the Nifty 50 and Tech Bubble of old. Consider this: at the end of 2024, the market cap of the S&P 500’s ten largest companies hit ~$20 trillion, while U.S. GDP was ~$30 trillion—meaning these mega-caps are nearly 70% of the economy, a historic high. If they continue to outperform, assuming conservative assumptions (6% annualized returns & 2% GDP growth), then these ten companies would be larger than the entire U.S. economy in 10 years. Does that seem realistic to you?

We think it’s fair to question the limits of this momentum run. When credit spreads reach multi-decade lows and steady stalwarts like Walmart and Costco start trading at multiples typically reserved for Silicon Valley startups, then it’s time to shake off the complacency and reassess the risk assumptions.

If history is a guide, relying on multiple expansion from today’s elevated levels is risky. While it’s easy to get caught up in the excitement of rising valuations and momentum, it’s fundamentals that will keep you in the game when sentiment shifts. The first months of 2025 may mark the unwind of the momentum trade—but, as always, hindsight will provide the ultimate clarity.

Successful long-term investing isn’t based on luck. It relies on a few timeless principles: earnings matter, dividends matter, and valuation matters. When these fundamentals take a backseat to speculation, the odds tilt against us.

Fundamentals Keep the Odds in Our Favor

We shouldn’t confuse investing with a trip to the casino—one builds wealth over time, the other builds regret overnight. Betting on endless valuation expansion without reassessing risk is dangerous.

The key to long-term success is staying in the game while ensuring we play with an advantage. As fundamental investors, we find that advantage in earnings growth stability, balance sheet strength, dividends, and reasonable valuations.

These fundamentals haven’t been an advantage in the recent momentum-fueled market environment, but history proves they increase our odds of success in the long run. In the end, it’s the steady, disciplined investor who wins the game.

Momentum-driven markets often mask underlying fragility. While rising valuations can be self-reinforcing for a time, history teaches us that when ‘the music stops,’ multiple expansion can unwind rapidly.

View Our Strategies

See the latest performance data