Will the Fed end up taking the elevator or the stairs? Why you should stay up in Quality as rates head down.

Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

- After 14 months, the Federal Reserve finally began its easing cycle. It cut the federal funds rate by 50 basis points, marking an end to the 2nd longest pivot window on record—the period between the last hike & first cut.

- Historical data suggest equity volatility often increases during rate-cutting cycles, especially if driven by economic weakness. The first rate cut has rarely been a green light for investors to broadly embrace risk.

- Quality factors—such as strong balance sheets, high returns on capital, and stability—tend to outperform during rate cutting cycles and economic downturns. Between historical precedent and additional risks posed by a looming debt maturity wall, we believe investors should remain over-indexed to Quality.

Perspectives on the Market

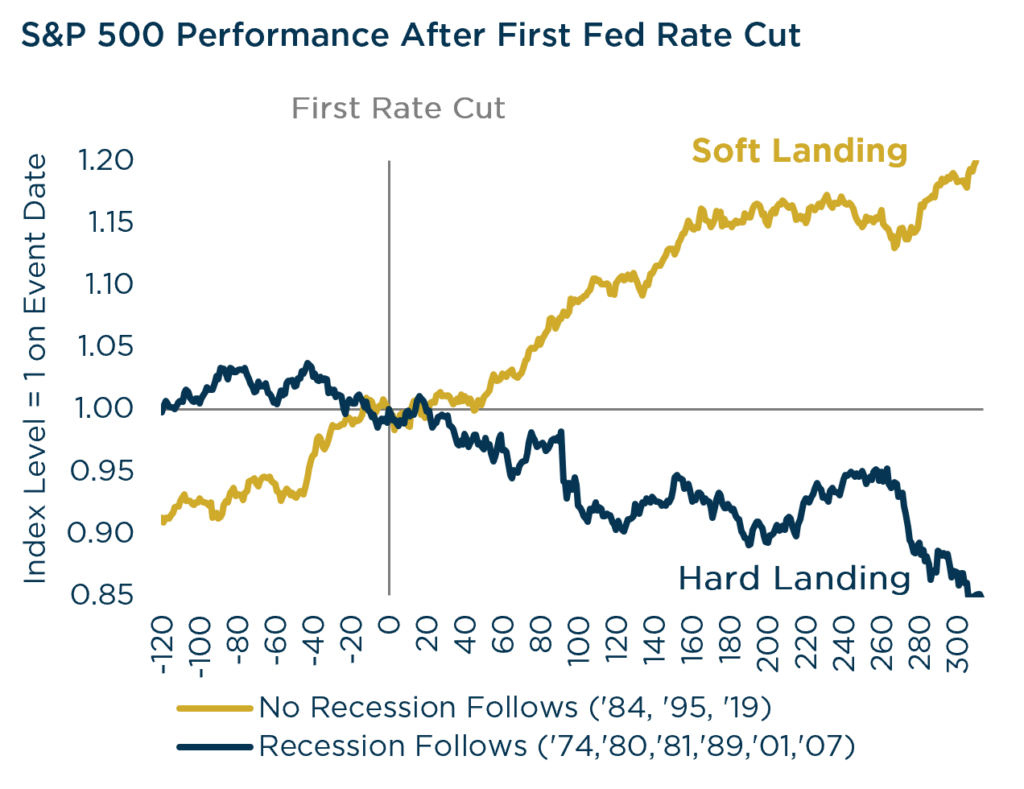

It’s been 14 long months since the Fed’s last rate hike, and now policymakers are finally ready to start cutting rates. Since the last rate hike, economic data has been mixed, but equity markets have climbed the proverbial wall of worry. Modest equity gains during the ‘Fed pivot window’ are fairly common throughout history. Further, over the course of a full rate-cutting cycle (first rate cut to the last), equities typically benefit from a reprieve in higher yields. That said, the path along the way is typically quite volatile, and it largely depends on whether the economy experiences a hard or soft landing. Now with the Fed poised to finally cut rates, we wanted to share some historical refreshers and provide context for why we believe investors should stick with Quality.

Source: Piper Sandler. 2019 episode excludes period of COVID selloff & recovery. 1980 periods goes through the first rate hike. Data from 3/14/1974 – 8/31/2024. Past performance should not be taken as a guarantee of future results.

Rate Cuts: Careful What You Wish For

With many investors thirsty for an aggressive rate cutting cycle, we’re inclined to be more cautious. When rates are declining, we should always first ask why? If rates are falling due to unexpected economic weakness, that is usually bad news for equity prices. In easing cycles where the deterioration in employment is modest (i.e. soft landings), equity prices typically grind higher.

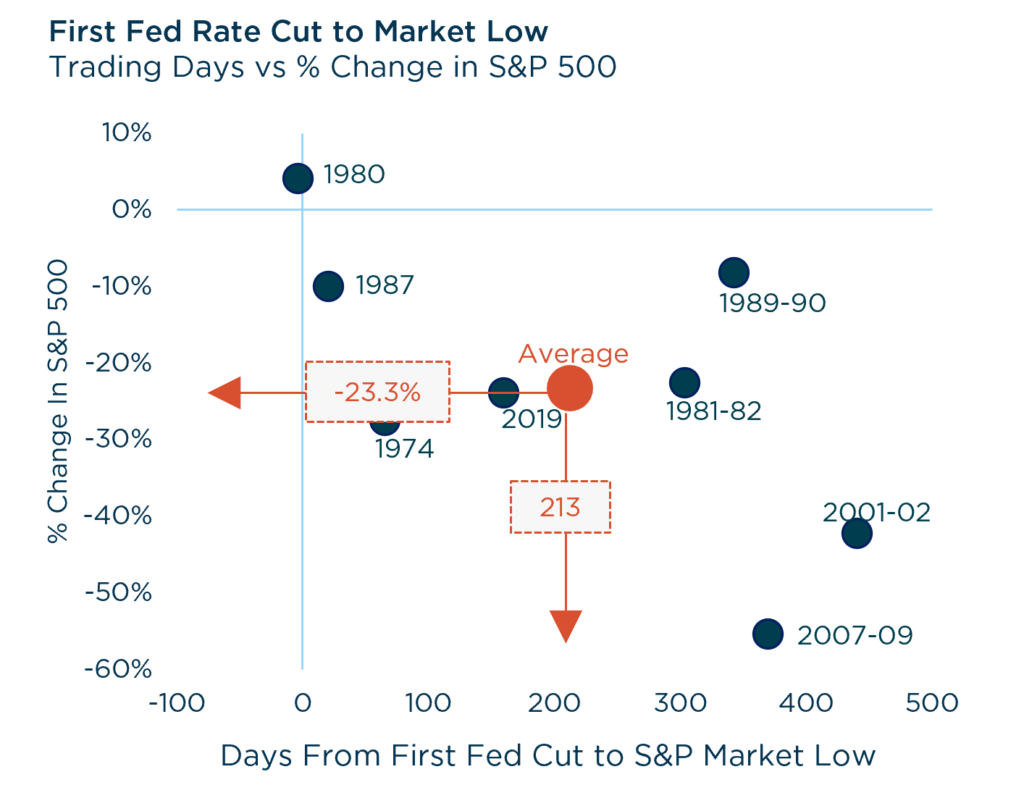

Historically, some of the biggest drawdowns in prior bear markets occurred after the Fed started cutting. The ‘long and variable lags’ of monetary policy apply to cuts just as they do to hikes, making it very difficult to precisely calibrate policy. This why the Fed has gained the reputation for taking the stairs on the way up and the elevator on the way down; which is to say, most interest-rate cycle ends with rapid rate cuts because the Fed overtightened.

Source: Strategas. Data from 7/1/1974 – 8/31/2024. Excludes 1984 and 1995 rate cutting cycles because the market never made a new low. Past performance should not be taken as a guarantee of future results.

Stick with Quality

When looking at the prior five rate cutting cycles, we see several market factor trends emerge. For this analysis, we looked at the average performance for each factor across the rate cutting cycles that began in July’19, September’07, January’01, July’95 and June’89. Quality, Value, and Yield factors all have positive results leading up to and following the initial rate cut. Meanwhile, Volatility and Risk factors tend to underperform.

This aligns with the prior observation that rate cuts are often in response to economic weakness. Quality market factors typically perform best late in the economic cycle and during recessions. The relative certainty provided by stability, wide margins, high returns on invested capital & balance sheet strength becomes disproportionately valuable during periods of distress. The interest rate sensitive Value and Yield factors also typically benefit from a Fed cutting cycle. Meanwhile, the macroeconomic struggles, faced by the lower quality, highly cyclical segments of the market, has historically more than offset the relief from lower rates. In other words, the first rate cut has rarely been a green light for investors to broadly embrace risk.

Source: Piper Sandler. Measures the forward price return of the companies in the S&P 1500 high & low quintile baskets of stocks by factor. Factors are sector neutral. Quintile baskets are rebalanced monthly at the beginning of each month. Individual factors serve as proxies for broader factor category. The initial rate cut periods represented include 6/5/1989, 7/6/1995, 1/3/2001, 9/18/2007, & 7/31/2019, and the chart displays the average factor performance for the five periods. Data from 6/5/1988 – 8/31/2024. Past performance should not be taken as a guarantee of future results.

In Summary

It remains to be seen whether we see a soft landing or a hard landing from here. Even still, the absence of a recession is not the presence of a recovery. With a forward P/E multiple of 21x, the S&P 500’s valuation appears high; meanwhile, credit spreads are still near post-pandemic lows. With less and less bad inflation news to price out, the market appears increasingly susceptible to weakening macro data.

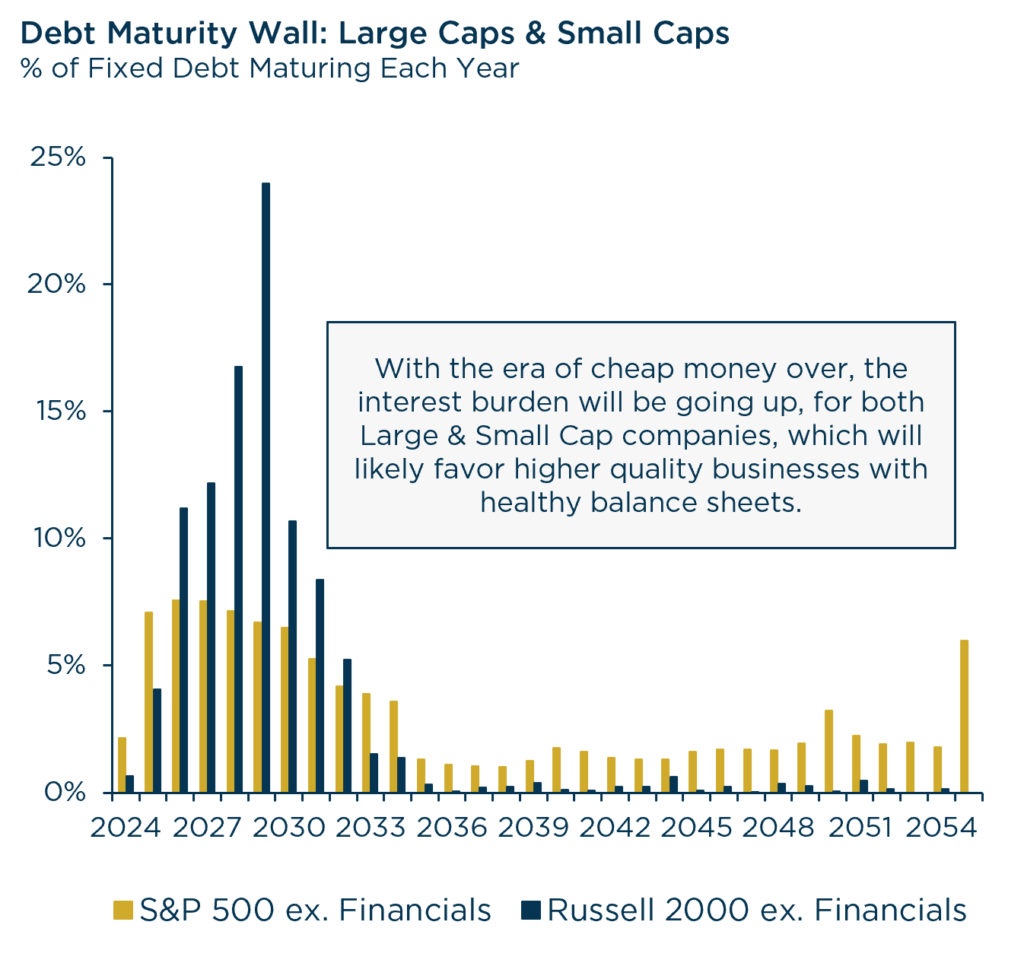

Amidst the macroeconomic and policy uncertainty, one thing is clear—a major debt maturity wall looms on the horizon. As interest rates normalize to less restrictive territory, even ‘normalized’ rates will lead to refinancing risk and higher debt servicing costs. Which may cut into corporate profits, capital spending, hiring, economic growth, and investor returns. Lots of debt and higher rates are a bad combination, but that can get even worse if softening economic data leads to lower earnings.

In our view, investors should remain over-indexed to Quality factors. Attributes like a strong balance sheet and the ability to self-finance operations are poised to stand out as tangible competitive advantages in the months, quarters, and years ahead.

Source: Strategas. Data as of 8/12/2024.Past performance should not be taken as a guarantee of future results.

View Our Strategies

See the latest performance data