Insights from the CIO

Founder, Chairman, and Chief Investment Officer

Investment Takeaways

- The AI surge has pushed the weight of momentum stocks to all-time highs. Dividend payers, lower beta and lower volatility stocks, as well as Small & Mid Cap companies, have not fully participated in the rally.

- Relative to Large Cap companies, Small & Mid Cap companies tend to outperform over the long term, but have underperformed in recent years, creating a valuation discount.

- During the era of easy money, Quality factors fell out of favor down the market cap spectrum. In a ‘higher-for-longer’ rate environment, however, we believe Quality factors will continue to grow in importance, testing smaller companies with looming debt maturities.

- Increased borrowing costs and slowing growth have already started to refocus attention toward earnings durability and balance sheet strength.

Perspectives on the Market

The arrival of summer hopefully brings some lazy days soaking up sun by the pool, enjoying favorite campsites, or at backyard barbecues with family and friends. Perhaps the downtime will also allow us to reflect on the robust market performance year to date.

Like summer, the remarkable AI-driven rally will eventually come to an end, probably sooner than most would hope. While we can look at our calendars and mark the day that kids return to school, the end of momentum stock rallies unfortunately tend to be a little less predictable.

So, while we certainly don’t want to wish away the recent market gains any more than we want to wish away the summer, it’s reasonable to reflect on the run-up in momentum stock valuations and take a look at areas of the market left behind. While the days, and the market bulls are still long, let’s prepare our portfolios for the seasons ahead.

Opportunities Beyond AI

The artificial intelligence (AI) boom that began last year has continued to garner capital investment and financial headlines in 2024. Now, the weight of high momentum stocks is at all-time highs, as are the idiosyncratic risks associated with a handful of mega-cap stocks. As we have noted in past writings, many other areas of the market haven’t fully participated in this rally. Such areas include dividend payers, lower beta and lower volatility stocks, and companies further down the market cap spectrum.

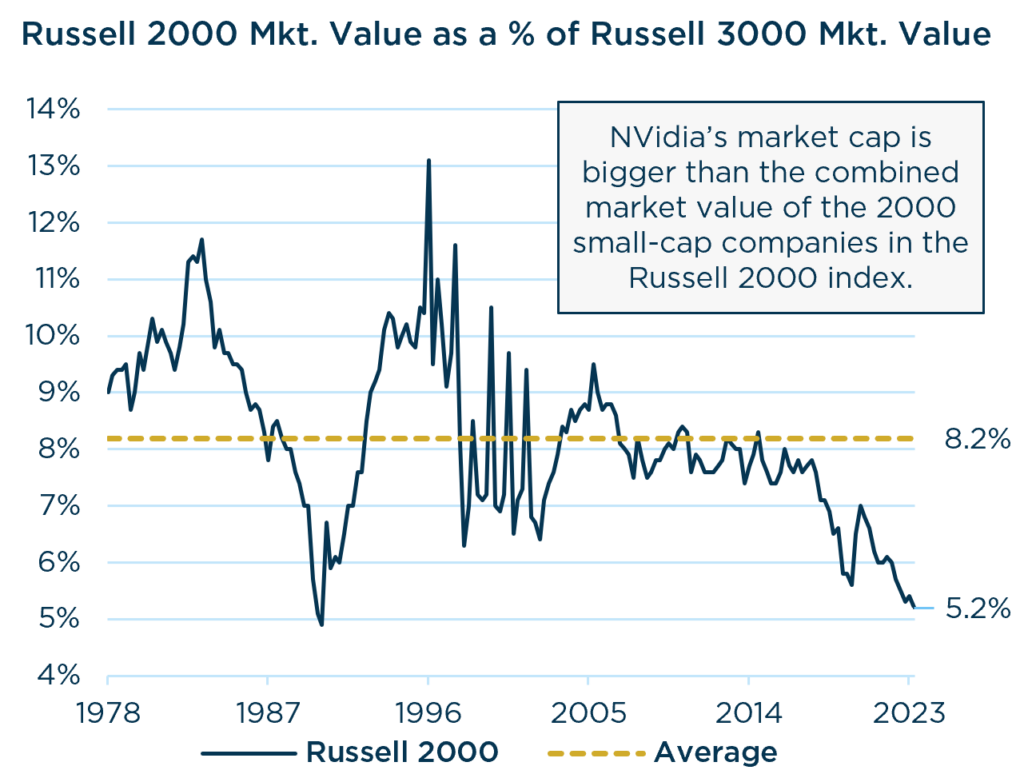

Small Caps have been lagging behind their Large Cap brethren for 14 years—the 2nd longest stretch on record. The AI boom has only magnified that divergence. In fact, the market value of Small Caps is approaching just 5% of the total U.S. equity market value. For context, the market cap of NVidia, the most prominent AI darling, also represents roughly 5% of the total U.S. equity market value.

Any significant reversion would likely favor broader participation across market caps, but broader does not equal universal participation. July will mark one year since the last rate hike. The predicted cuts in 2024 will only have a modest impact on borrowing costs, and the “higher-for-longer” rates amid slower growth may test the mettle of weaker companies. With the era of cheap money over, the interest burden will be going up, which will likely favor businesses with healthy balance sheets.

Source: Furey Research Partners. Data from 12/31/1978 – 3/31/2024. Past performance should not be taken as a guarantee of future results.

Why Consider Small & Mid Caps Now

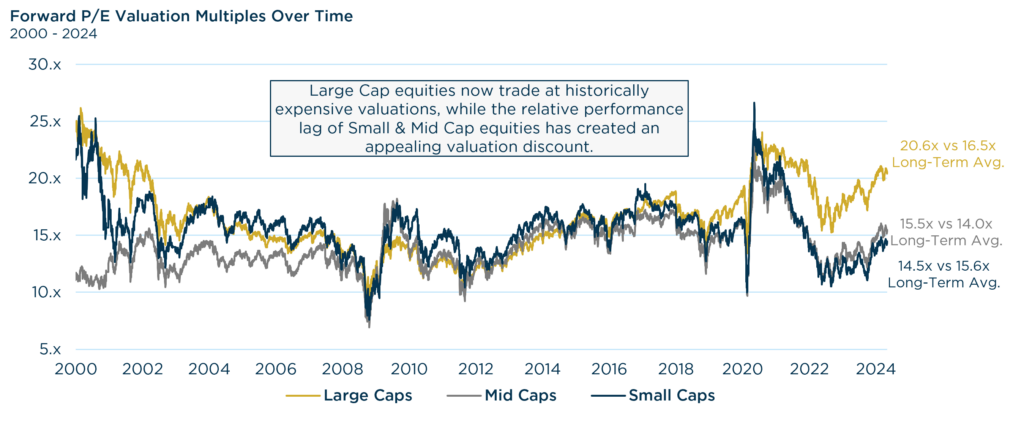

Relative to Large Cap equities, Small & Mid Cap stocks tend to exhibit higher volatility, but they also historically generate higher revenue growth and returns over the long term. Over the past decade, however, Large Cap indices have outperformed their smaller-cap counterparts. In the ten years ending March 2024, the S&P 500 outperformed the Russell 2000 by more than 500bps per year and the Russell Midcap Index by 300bps per year. As a result, Large Cap equities now trade at historically expensive valuations, while the relative performance lag of Small & Mid Cap equities has created an appealing valuation discount.

Additionally, the outperformance of Large Cap stocks has been highly concentrated. The S&P 500 Index’s return in 2023 was the second most concentrated relative to its Top 10 holdings in the last thirty years. Prolonged periods that favor lower capitalizations have often followed episodes of concentrated performance.

According to Furey Research Partners, the Small/Large relative valuation ratio is at 50-year lows and Large Cap concentration is at 50-year highs. Extreme relative valuation and concentration conditions were also observed at the start of past Small-Cap cycles, like in 1973 and 2000.

Given the attractive valuation discounts and the long-term track records of strong revenue growth & returns, we believe investors are currently being paid to take the risk of greater volatility in Small & Mid Cap equities. That being said, there are key considerations that investors should be mindful of. In particular, Quality down cap has eroded over time. The recent normalization of Fed policy has already begun to expose the haves and the have-nots. We see increased borrowing costs and slowing growth refocusing attention toward earnings durability and balance sheet strength. In our view, the case for Quality down cap is a strong one.

Sources: FactSet. Data from 1/31/2000 – 5/31/2024. The Large Cap, Mid Cap and Small Cap proxies are represented by the S&P 500, S&P 400, & S&P 600, respectively. Past performance should not be taken as a guarantee of future results.

Quality: Why It Matters Down Cap

Momentum, Growth, & Size factors have fueled recent equity performance, but Quality has been the single factor to consistently deliver excess returns over time (CFA Institute) . However, during the era of easy money, Quality fell out of favor as cheap capital boosted highly leveraged, unprofitable companies. The percent of smaller-cap companies with no earnings rose significantly following the Global Financial Crisis, and abundant access to cheap debt helped prop up Zombie Companies—those unable to service debt out of cash flow. We see this trend beginning to shift.

Extreme relative valuation and concentration conditions were also observed at the start of past Small-Cap cycles, like in 1973 and 2000.

Quality factors, such as Return on Invested Capital and Interest Coverage, were generally positive across the broad market in 2023. That said, the relative advantage of Quality factors has been highest down the market cap spectrum, as their impact on relative results has been diminished at the Large Cap level by the strength and skew of the Magnificent 7.

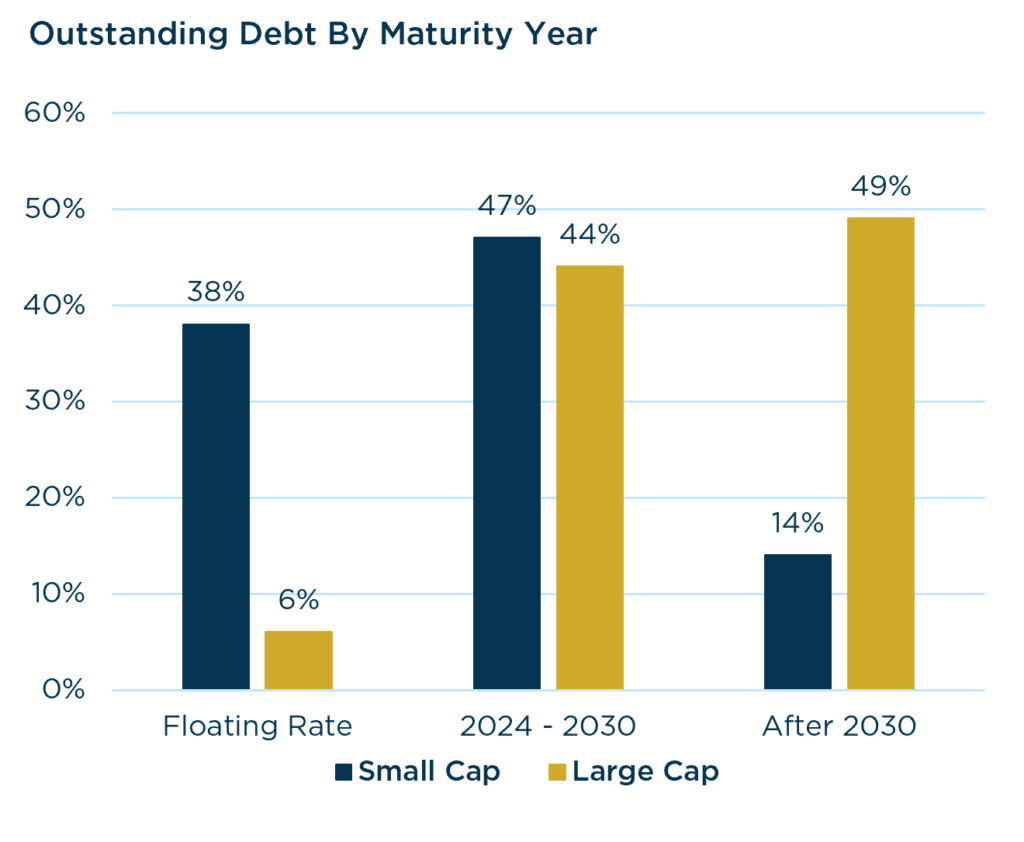

Highly leveraged companies are more likely to struggle to refinance maturing debt in a “higher-for-longer” rate environment, and a significant corporate debt maturity wall looms on the horizon. Small caps are poised to hit this wall sooner than large caps.

Source: J.P. Morgan Asset Management. Data as of 12/31/23. Represents % of total debt outstanding, excluding financials. Russell 2000 is used for Small Caps and the S&P 500 is used for Large Caps. Past performance should not be taken as a guarantee of future results.

We anticipate that these dynamics will create substantial challenges for lower-quality, smaller-cap companies in the years ahead. Rate reprieves may spur some relief rallies, especially since nearly 40% of outstanding Small Cap debt is floating rate. Junkier parts of the market may experience short-term boosts, but we believe Quality factors, with an emphasis on balance sheet strength, are best positioned for the intermediate and long term.

As active managers who focus on quality and downside protection, we aim to help our investors capitalize on the attractive relative valuations down cap while avoiding the pitfalls associated with lower-quality, smaller-cap companies.

In Summary

While inflation has moderated substantially on a year-over-year basis, it remains too elevated to dismiss its impact. Recession risks have faded, but as long as inflation persists, so too will higher rates and below-average growth. Pressure to generate returns may continue to bolster the Magnificent 7 stocks for a while, but momentum has its limit.

We don’t know when the AI momentum rally will end, but such rallies often end sharply, and the catalysts are usually not apparent until after the cycle changes. Attempting to time any significant market drawdown is usually a fool’s errand, but high valuations often play a significant role.

For long-term investors, we believe the opportunities down the market cap spectrum are compelling. This comes at a time when quality among smaller cap companies has eroded and the normalization of interest rate has reshaped the contours of the investment landscape. Taken together, we believe these dynamics could favor active management with a quality orientation in the Small & Mid Cap space for years to come.

We hope the summer brings you fair weather and fond memories. But please be mindful of downside risks too – apply plenty of sunscreen and keep an eye on those clouds for any unexpected storms.

Highly leveraged companies are more likely to struggle to refinance maturing debt in a “higher-for-longer” rate environment, and a significant corporate debt maturity wall looms on the horizon. Small caps are poised to hit this wall sooner than large caps.

View Our Strategies

See the latest performance data